Commodities bull run

3 Apr, 2024

Category: Commodities

Tags: Commodities

Easiest way to ride on the commodities bull run

Gold, silver, copper, cocoa, sugar, palm oil – you name it, they're all hitting new highs! It's like the whole commodity market is on fire right now!

Price chart for Invesco Optimum Yield Diversified Commodity Strategy No K-1 ETF (Stock Code: PDBC)

Price chart for Invesco Optimum Yield Diversified Commodity Strategy No K-1 ETF (Stock Code: PDBC)

But why is this happening? Well, some commodities are seeing price hikes due to supply issues, but what's really interesting is the surge in gold and silver prices. Could it be that more and more people are losing faith in traditional currencies like the US Dollar? It's a bit strange to see gold soaring to new heights, especially when US interest rates are at their peak.

Maybe, just maybe, it's a sign that the value of our paper money isn't as secure as we once thought. After all, currency is just a medium of exchange – it's not real money. The paper in our wallets and the digits in our bank accounts lose value every day.

So, what's the solution? Commodities and real estate are things that tend to keep their value over time. Investing in real estate means buying houses or investing in REITs. But I also wanted to know how to invest in commodities. So, I did some research. Turns out, ETF that provide direct exposure to the price movement to commodities is the easiest way.

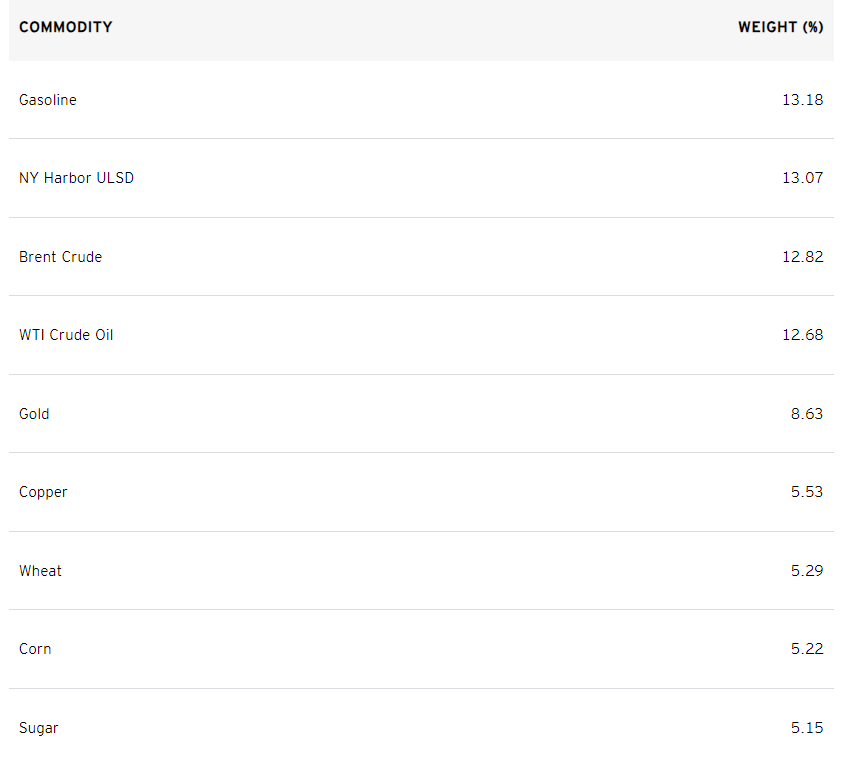

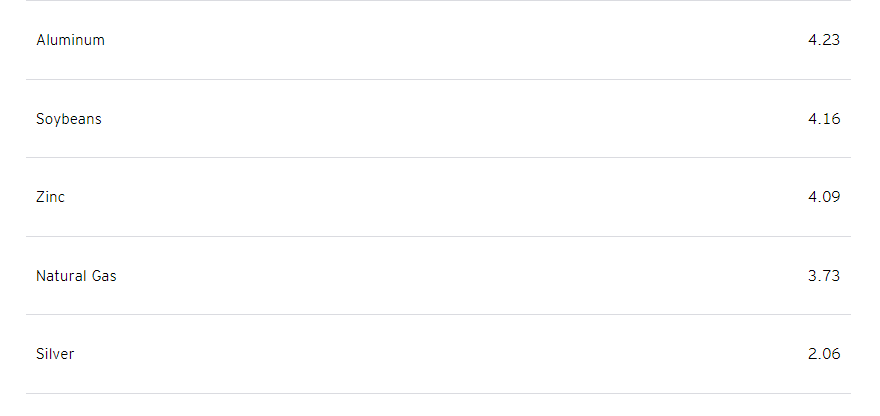

Among the ETFs offered, Invesco Optimum Yield Diversified Commodity Strategy No K-1 ETF (Stock Code: PDBC) is the largest ETF with a wide range of commodities in its portfolio.

From gasoline, ultra-low sulphur diesel, crude oil, gold, copper, wheat, corn, sugar, aluminium, soybean, zinc, natural gas and silver. Plus, with Futu Moo Moo, you can easily buy and trade PDBC.

I've got a feeling that the investing landscape in 2024 is shaping up to be a lot like 2020 and 2024 may be commodities' best year.

Related Articles

A Game-Changer in the Copper Mining Industry

2024-04-26

|

Commodities

|

Tags: Copper

The merger could create a conglomerate controlling approximately 10% of the world's copper production

The copper wave

2024-04-25

|

Commodities

|

Tags: Copper

Copper prices driven by tight supplies and strong demand prospects

The Surge in Cocoa Prices

2024-01-03

|

Commodities

|

Tags: Cocoa

Discover the factors behind this surge, the challenges faced by top cocoa producers, and the ripple effect on chocolate manufacturers