Comparison of Revenue of major semiconductor manufacturers

15 Aug, 2022

Category: Semiconductor

Tags: Semiconductor

Intel weak share price performance is substantiated by its stagnant revenue

![]()

The revenue of Intel has barely increased over the last 5 years while TSMC has recorded tremendous growth in the same period. As a result, Intel's share price has been underperforming TSMC by a huge margin.

The biggest difference is Intel has been plagued by delays after delays over the last few years.

Same theory, when a company is delaying its capital expenditure plan, again and again, the future may look bleak for the company too.

To check our companies that are terminating or halting their expansion plan, users can check out here.

Related Articles

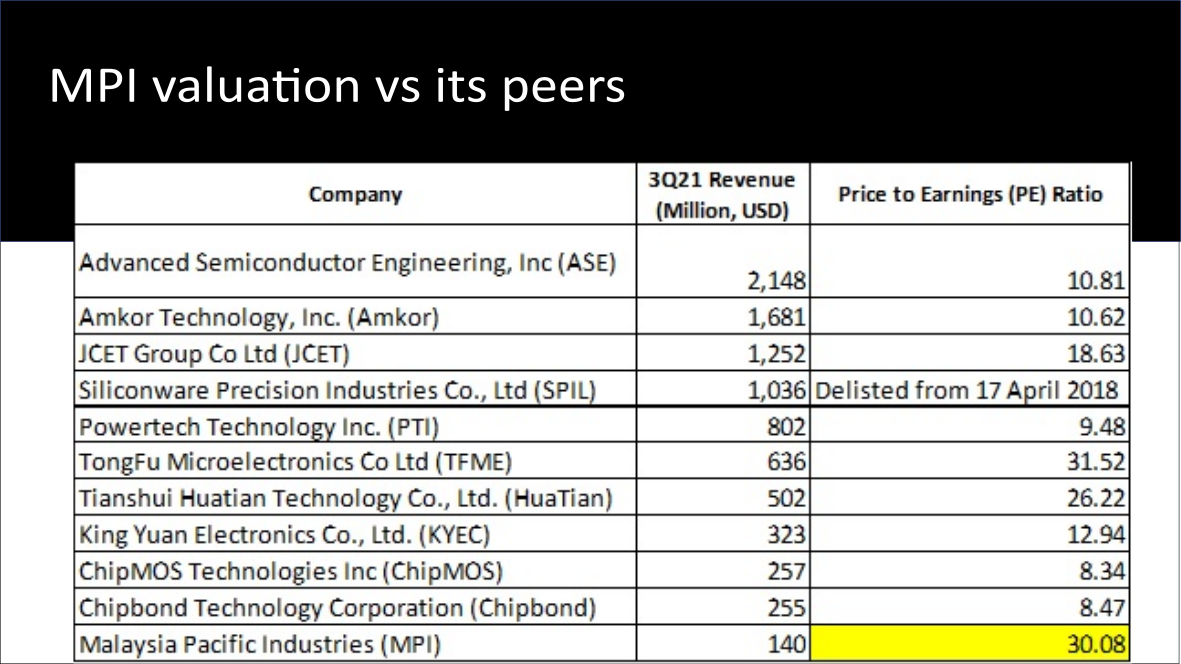

Malaysia Pacific Industries (MPI) and its Peer

2023-08-09

|

Semiconductor

|

Tags: Portfolio

A quick glimpse comparing the valuation of Malaysia Pacific Industries (MPI) and its major counterpart

Inari Amertron - Value emerges?

2023-08-09

|

Semiconductor

|

Tags: Inari Amertron

Can investors catch this falling knife after a 25% share plunge in a short period of time?

为什么这次Nvidia收购Arm会遭到反对呢?

2023-08-09

|

Semiconductor

|

Tags: Nvidia, Arm

从技术路线的关系明白英伟达为什么想收购Arm