Debt and Companies to avoid

27 Oct, 2022

Category: Opinion

Tags: Debt

Growth fueled with debt may be in trouble

Between 2000 and 2018, the global gross domestic product (GDP) rose from US$33.5 trillion to US$80 trillion, giving the impression of economic growth.

Over the same period, global debt grew even faster, rising from US$62 trillion to US$247 trillion. In other words, it took the world four dollars of debt to achieve every dollar of growth.

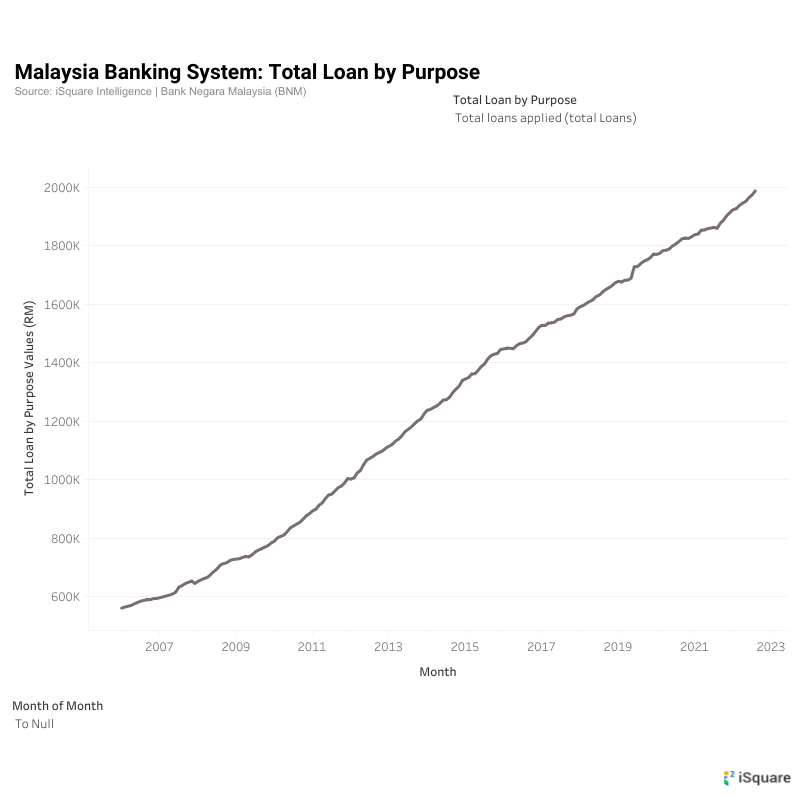

Same for Malaysia Situation. From Jan 2006 to Aug 2022, our total loan in the banking system grows from RM 560 billion to RM 1.98 trillion, a growth of 355%. In the same period, our GDP only grow by 229%.

Economies are increasingly leveraging themselves to drive growth but unproductive debt makes growth harder to achieve because borrowings need to be repaid.

As growth slows and obligations rise, the risk of default increases.

Avoid these companies:

1) Debt increase faster than revenue and asset

2) Cost of debt is higher than Return on Asset (ROA)

3) Mismatch between the currency composition of liabilities and revenue where the revenue is denominated in RM while the liabilities are denominated in USD

The market is rebounding but the bear is not ending. This window period serves as a good opportunity for you to balance your portfolio.

Related Articles

House Prices during high inflation and high interest rate era

2023-08-09

|

Opinion

|

Tags: Real Estate

Forecasting the housing market by referring to US 1970s era.

Misconception of salary

2023-08-09

|

Opinion

|

Tags: Politics

Having higher productivity equals a higher salary is a very wrong concept

Interesting Fact during social distancing period

2023-08-09

|

Opinion

|

Tags: Politics

|

Archived

What are keywords people have been searching for during the movement control period and what are the changes to people daily lifestyle?