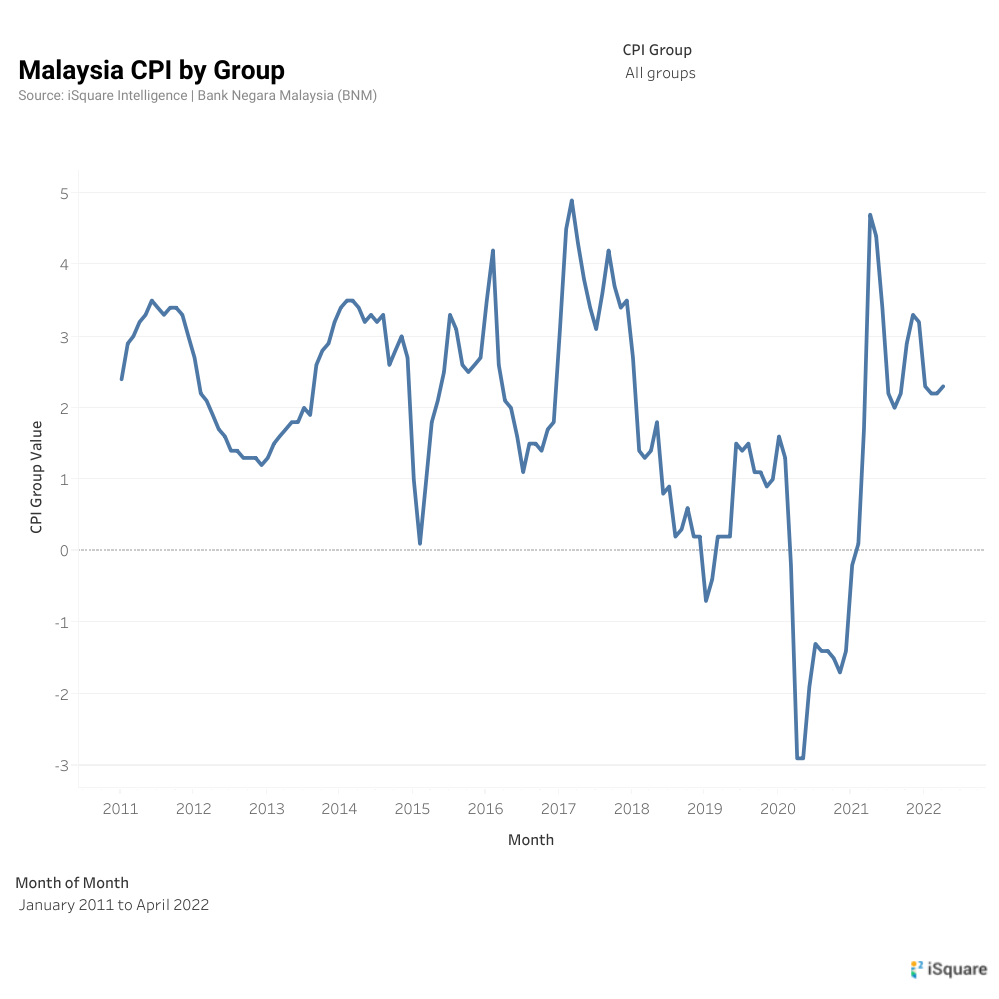

Real Estate under inflationary era

21 Sep, 2022

Category: Portfolio

Tags: Real Estate

Real estate sectors that are most likely to be resilient to inflationary pressures.

Six real estate sectors that are most likely to be resilient to inflationary pressures. These are: hotels, prime offices in key cities, rental properties on short-term leases, logistics assets, real estate in technology & innovation-linked hubs, and grocery-anchored retail parks.

Properties with contracted rents that are explicitly linked

to an inflation index are also well-positioned to benefit from high inflation

even during times of economic weakness, provided the tenants can maintain

rental payments.

Finally, the private rental sector, student housing, senior

living, and affordable housing all offer defensive characteristics for

investors, with these rents most closely related to inflation levels.

Related Articles

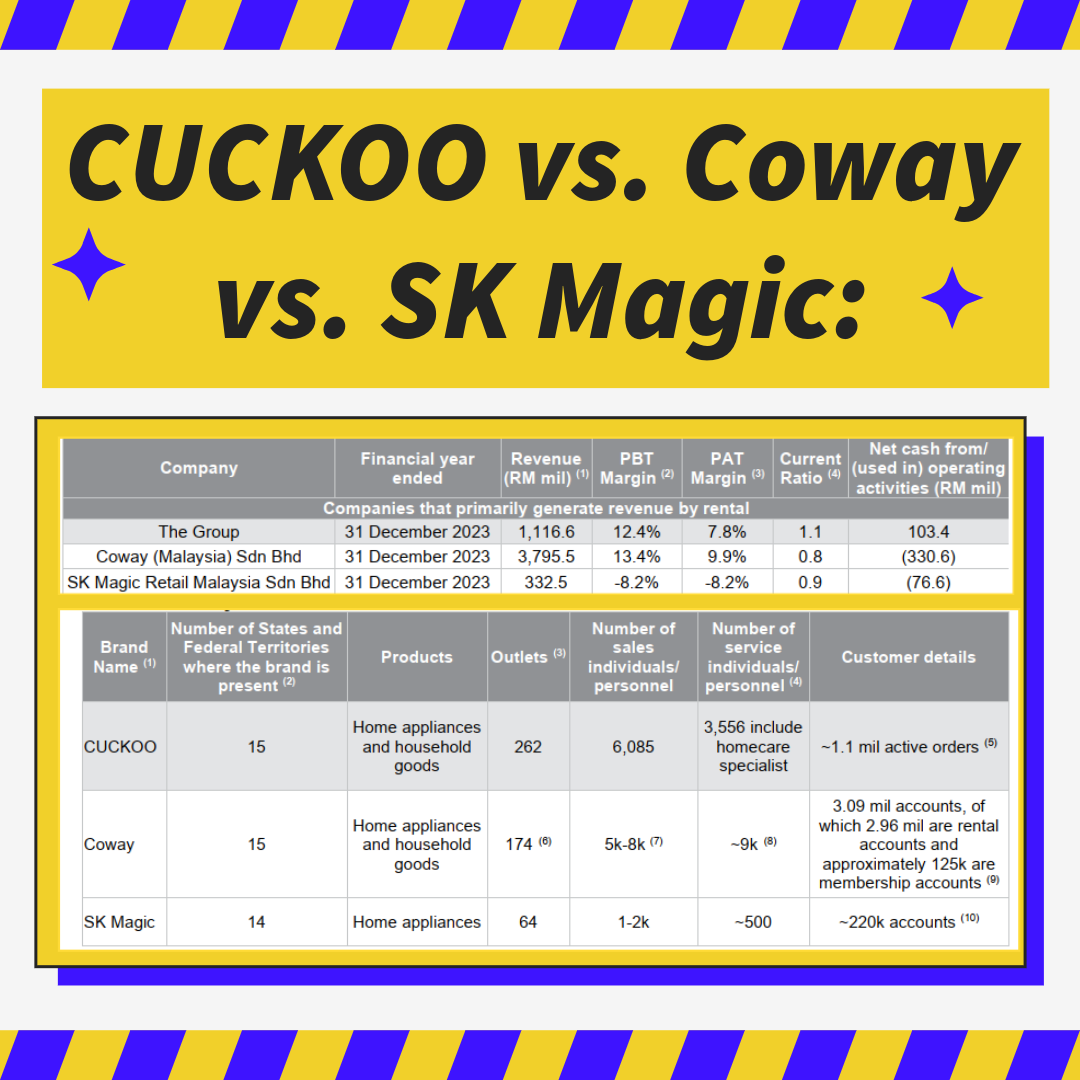

Cuckoo vs Coway

2024-11-03

|

Portfolio

|

Tags: Cuckoo

Comparison of household products leasing provider

Personal Investment Portfolio

2024-04-03

|

Portfolio

|

Tags: Portfolio

|

Archived

Personal Investment Portfolio that includes stocks, bonds, ETFs, futures and options.

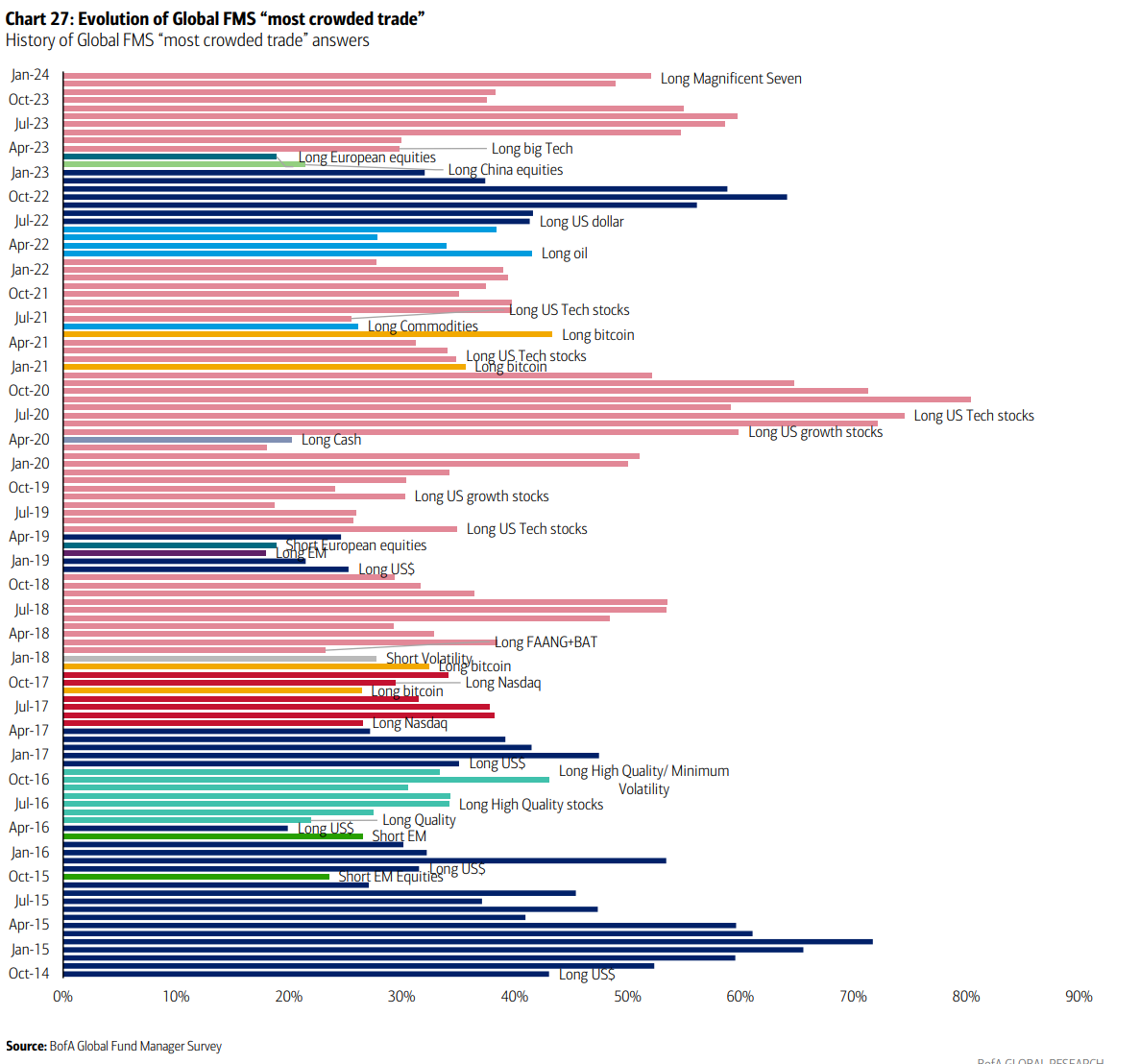

Don't Follow the Crowd

2024-03-26

|

Portfolio

|

Tags: Open Interest

Why Being a Contrarian Matters