Positions of different market participants for EUR/USD

13 Jul, 2022

Category: Currency

Tags: EUR,USD

A check on hedge funds' position when EUR/USD is trading at parity.

The EUR is trading at parity with USD, which means 1 EUR can only change 1 USD now. Not long ago, 1 EUR can fetch 1.2 USD.

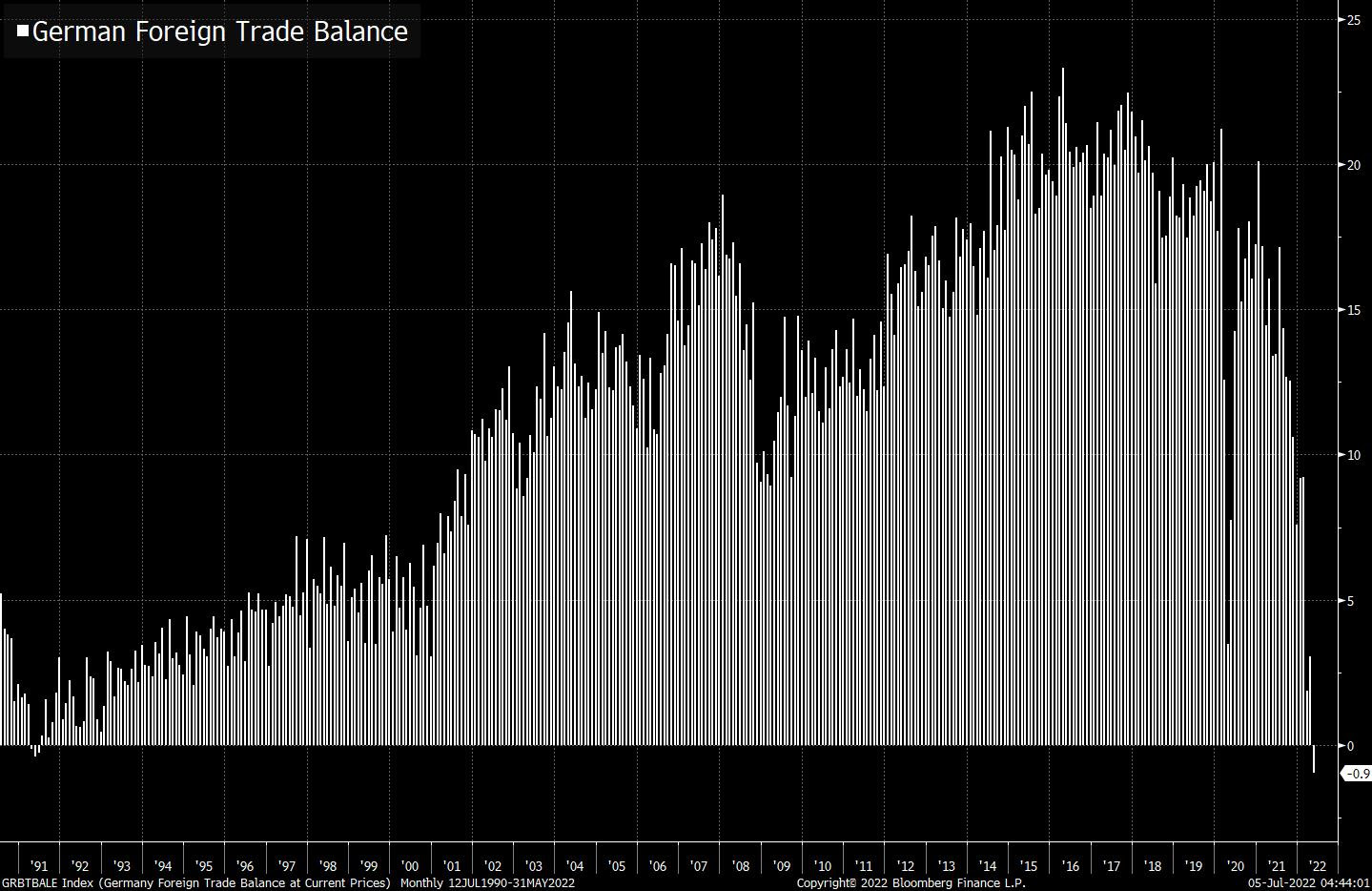

Some of the reasons that lead to the weak EUR are high energy prices, trade deficit, loose monetary policy, and the spread between US Government Bond and EU Nations' government bonds.

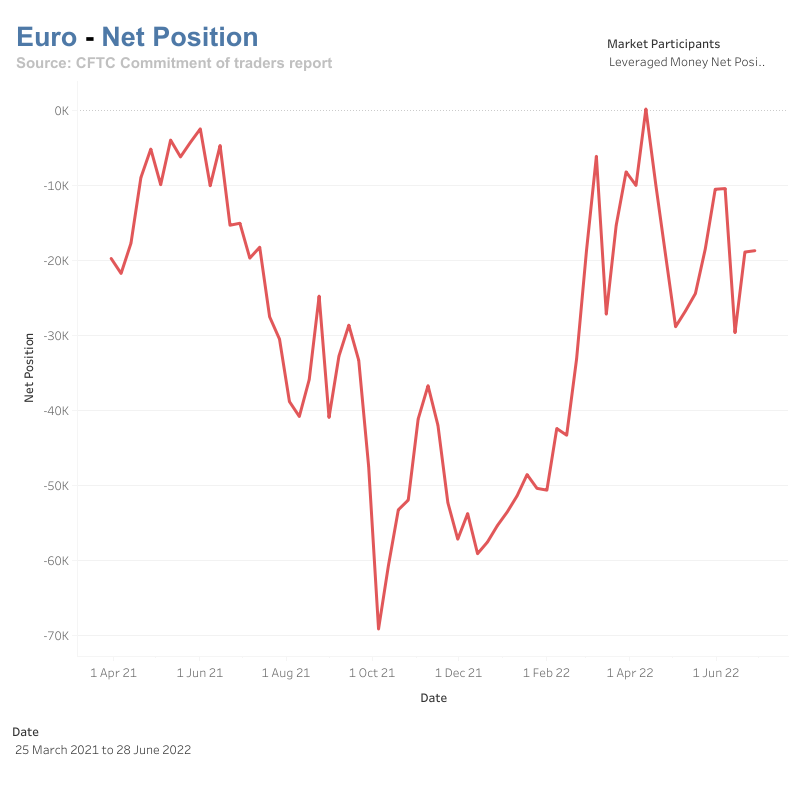

Let us take a look at the positions of Leverage Money (aka hedge funds) in the futures and options market. The hedge funds are still having a net short position on EUR although they had closed a huge portion of their short position since October 2021.

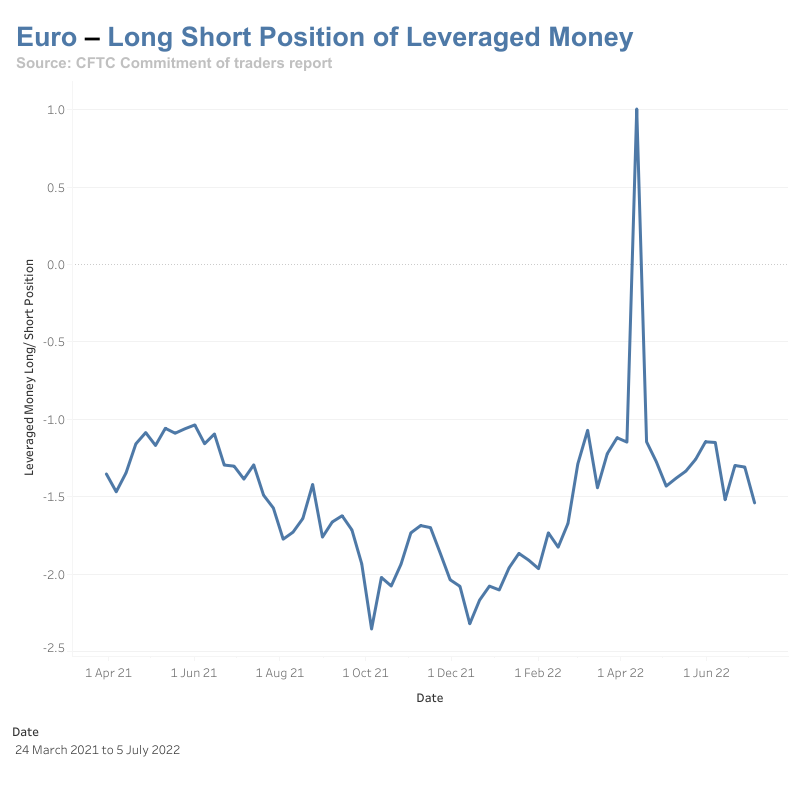

The long-short ratio of Leveraged Money is currently at -1.539. which means the number of contracts shorting the EUR is 153% more than the number of contracts long the EUR.

The trend is your friend. If you want to tap on this trend, you can open an account using my referral link.

Source: Net positions of market participants in EUR

Related Articles

Why JPY Falls after raising Interest Rate

2024-03-28

|

Currency

|

Tags: JPY

JPY reaching 1990 low after raising the interest rate

Financial Situation of Major Countries

2023-08-09

|

Currency

|

Tags: Country

The current account balance, budget balance, and interest rate of major countries.

Major movements in the currency market

2023-08-09

|

Currency

|

Tags: EUR, JPY, KRW

The market is volatile and opportunities arise.