The real reason for sluggish bank share price

6 May, 2022

Category: Banks

Tags: Interest Rate

Competition from Digital Banks is minimal, the hike in interest rate is the true factor

An increase in interest rate is good for banks as banks can receive a higher interest income from their loan book. However, the share prices of Malaysian banks have been sluggish despite the interest rate has shot up over the last few months.

The assets of a bank are mainly made up of loans (The money borrowers owed to banks) and financial assets hold (Government Bonds). In the case of Maybank, Malaysia's largest bank, Maybank holds 214 billion of financial assets and has a loan book of 541 billion.

If you are repaying your monthly mortgage, you will realize that the monthly repayment and the interest rate remain the same. The interest rate of loans in Malaysia is mainly determined by our Overnight Policy Rate (OPR), which is still fixed at 1.75%, hence there is no increase in interest income for banks from their loan assets.

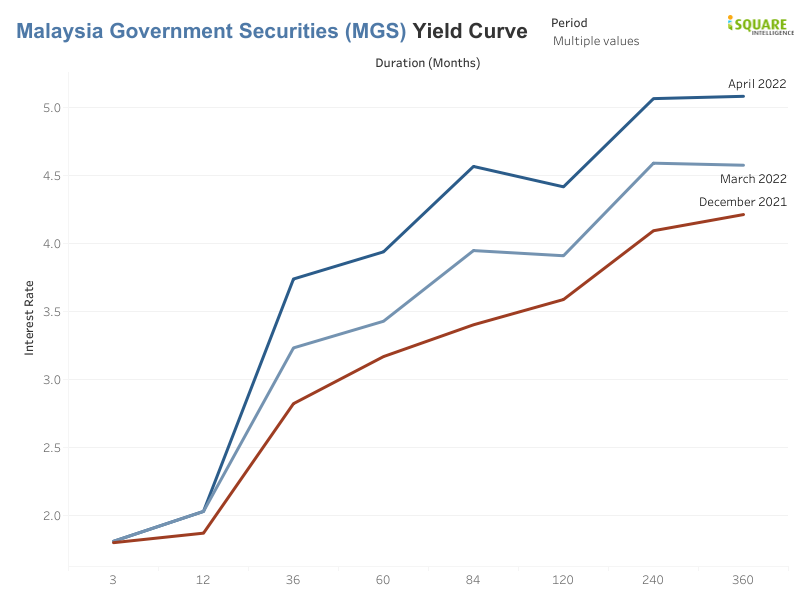

Source: MGS Yield Curve

On the other hand, the interest rate of Malaysia Government Bond had shot up so much. The yield of Malaysia Government Securities (MGS) has moved up tremendously if you compare Apr 2022 with Dec 2021. A higher interest rate means a lower bond price. As the bond price falls, there should be some adjustment (downward adjustment) in the value of financial assets held by banks. This Far Value Adjustment is not going to impact the profit and loss statement, but it will appear on Other Comprehensive Income, which will eventually affect the book of banks.

This is hard to understand if you are not from an accounting background. In short, you just need to know the price of the assets held by banks and this affects the book value per share of the banks. This is significant to the bank's share price as banks are valued at Price to Book (P/B) multiples.

Related Articles

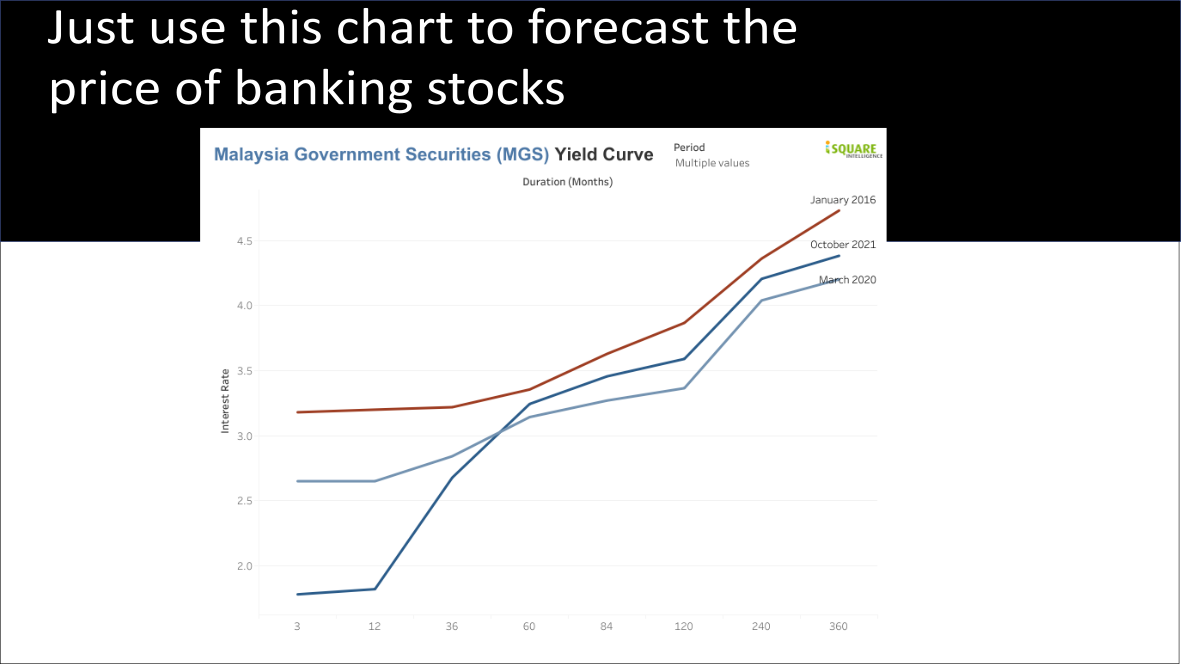

Just use this chart to forecast the price of banking stocks

2023-08-09

|

Banks

|

Tags: Portfolio

A useful tool to forecast the profitability of banking stocks

Fears are starting to grow in the banking industry?

2023-08-09

|

Banks

|

Tags: Portfolio

The share price of banks is not catching up with bond yields

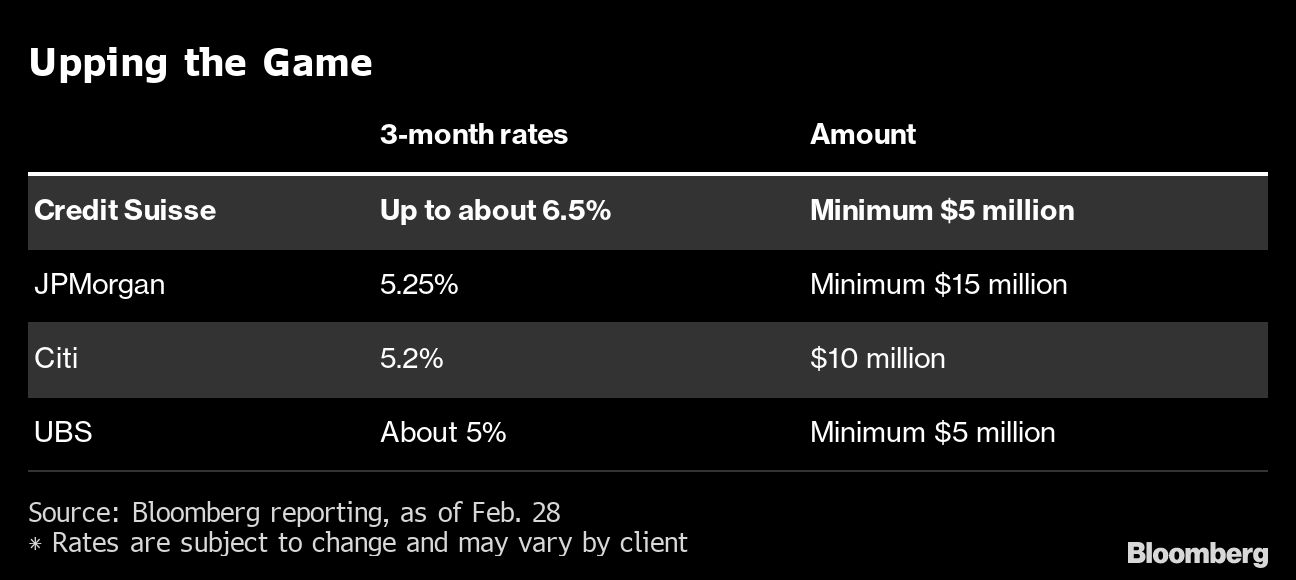

Credit Suisse brink of collapse

2023-08-09

|

Banks

|

Tags: Credit Suisse

redit Suisse is offering deposit rates as high as 6.5% for new money to win back clients, which may indicate a higher level of non-performing loans or credit risk.