Don't FOMO in this market

17 Nov, 2022

Category: Portfolio

Tags: Market Watch

Market risk is still high

The terminal interest for this round of interest rate hikes is expected to stay at around 5%. This has led to a strong rebound across all asset classes except cryptos.

To be honest

1) Strong rebound only happens in a bear market.

2) Asset with a long duration such as property and bonds are sensitive to interest rates.

3) Equities market requires an environment with ample liquidity, which means it needs a lot of money to make the stock market move higher.

4) Although the interest rate hike cycle is ending, the Quantitative Tightening (QT) action is not. Federal Reserve is still shrinking its balance sheet. (Unprinting money)

5) If we look at FRA-OIS spread, US Dollar is getting scarce. (The higher it is, it means investors outside of the US need to pay more to get US)

6) P/E ratio may be low, but earnings are expected to fall too.

There is always a risk in investing. The market still hasn't reached a once-in-a-lifetime opportunity stage. Don't FOMO.

Related Articles

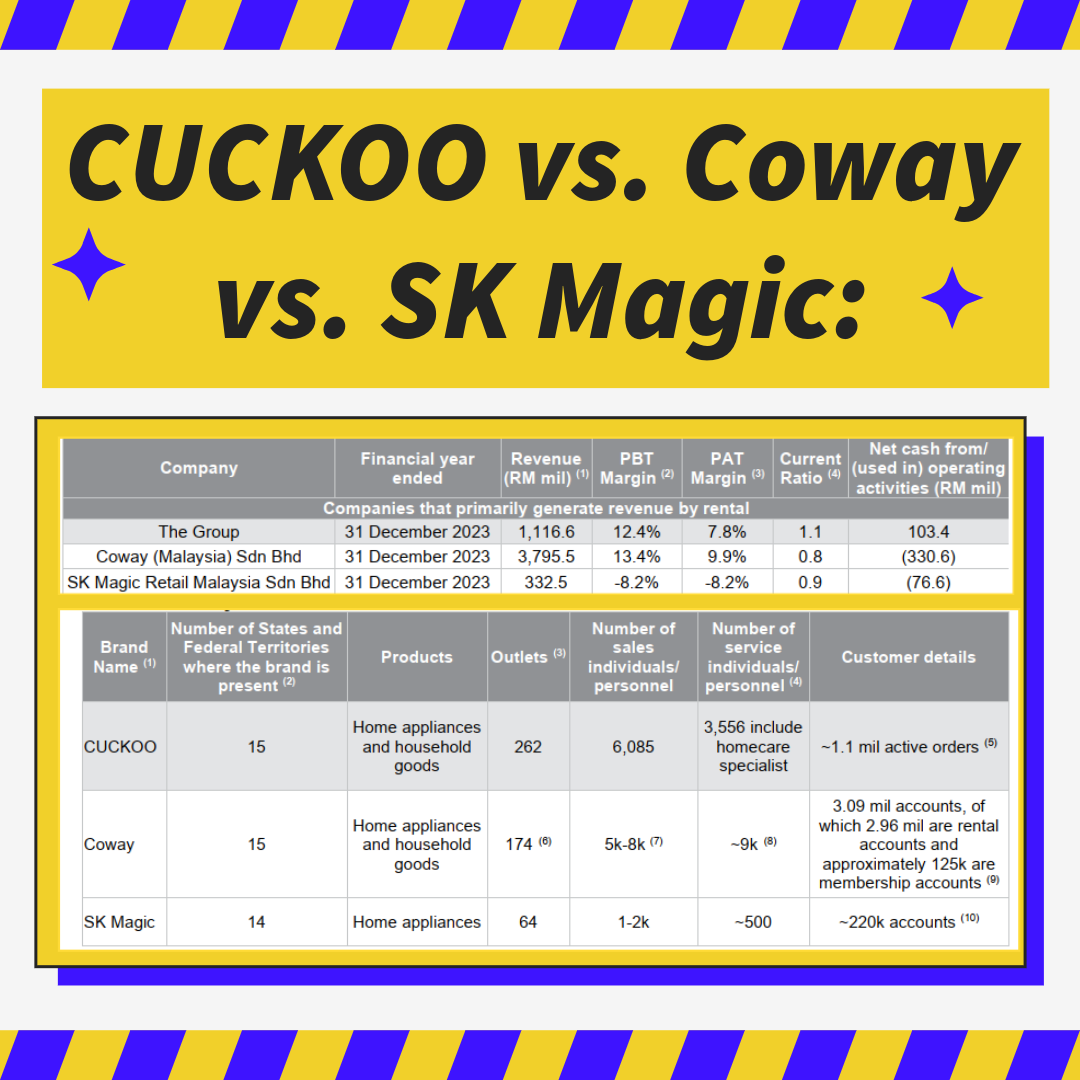

Cuckoo vs Coway

2024-11-03

|

Portfolio

|

Tags: Cuckoo

Comparison of household products leasing provider

Personal Investment Portfolio

2024-04-03

|

Portfolio

|

Tags: Portfolio

|

Archived

Personal Investment Portfolio that includes stocks, bonds, ETFs, futures and options.

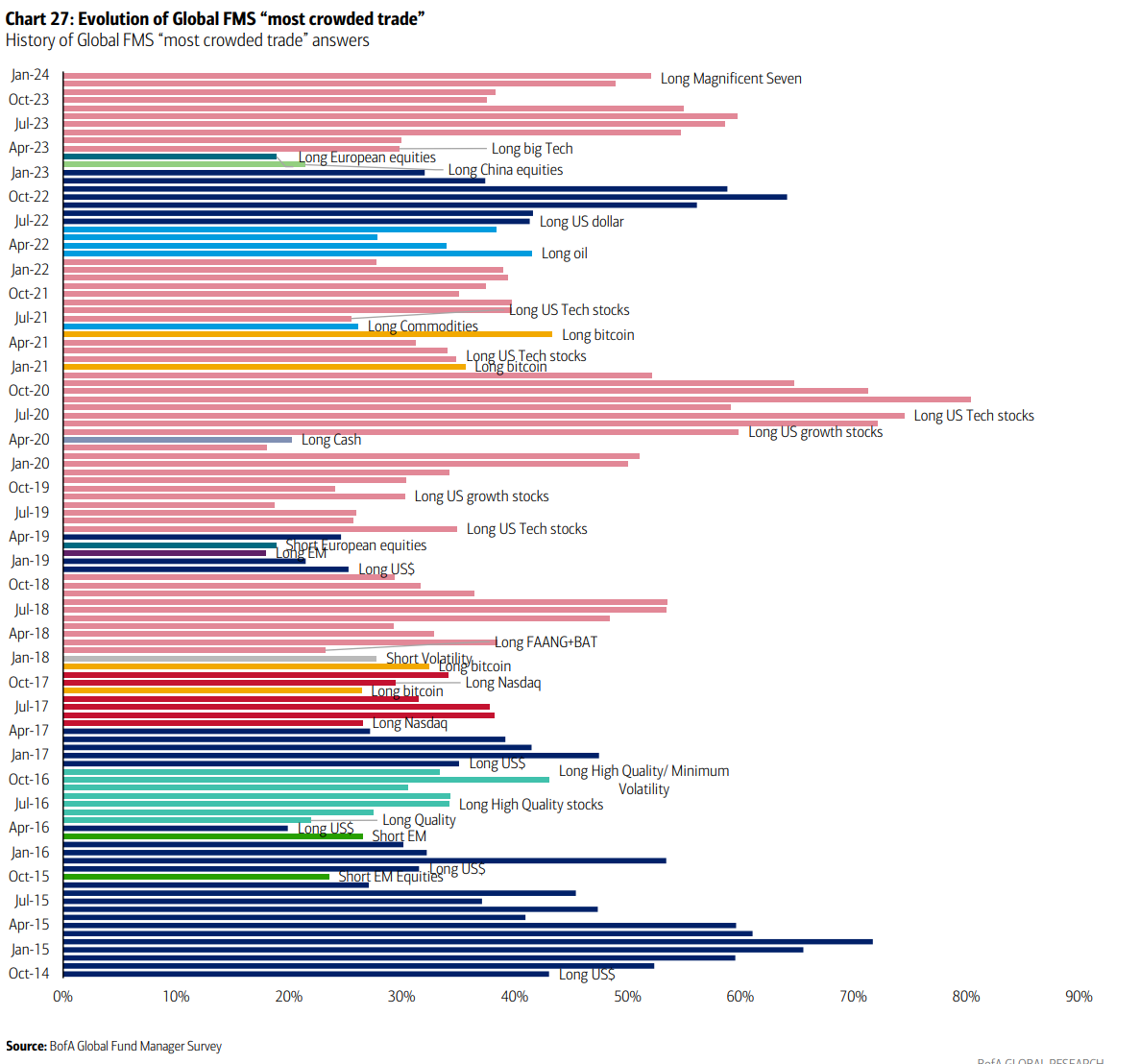

Don't Follow the Crowd

2024-03-26

|

Portfolio

|

Tags: Open Interest

Why Being a Contrarian Matters