How does a Reverse Take Over (RTO) works

RTO, a cheaper and quicker alternative to access to market capital

Local Assembly Sdn Bhd, a company involved in Electronic Manufacturing Services is taking over the listing status of LTKM, a poultry company. This is a reverse takeover (RTO) deal.

The RTO process is often referred as a “Back Door-Listing” involving a “Shell Company” which is currently trading on the markets.

Here is the process of how does an RTO works.

1) Local Assembly Sdn Bhd (LA) asks LTKM Bhd (Listco), which is loss-making and low price, whether the owner of Listco wants to sell its listing status or not.

The buyer of the Listco shell will usually pay approx RM 40 million directly to the owner of the Listco to facilitate this deal. The price is the cost of taking a mainboard listed shell. This price varies and will be lower during the sluggish market conditions. This deal is done directly and does not involve any public announcement.

2) Once the original owner of the Listco agrees, the owner will use the Listco to acquire LA and the acquisition will be satisfied via share issuance.

3) The shareholder of LA now become the largest shareholder of the Listco

4) The original shareholders, including minority shareholders of LTKM, now hold lessers of the enlarged company.

5) After a few months, the Listco will dispose of the original business (poultry) to the original owner of the company at a very low price.

6) A few months later, the original shareholder of the Listco will usually announce that he had slowly sold all his shares in the market and he is no longer a shareholder of the company

7) Lastly, the Listco will change its name and the whole process is done.

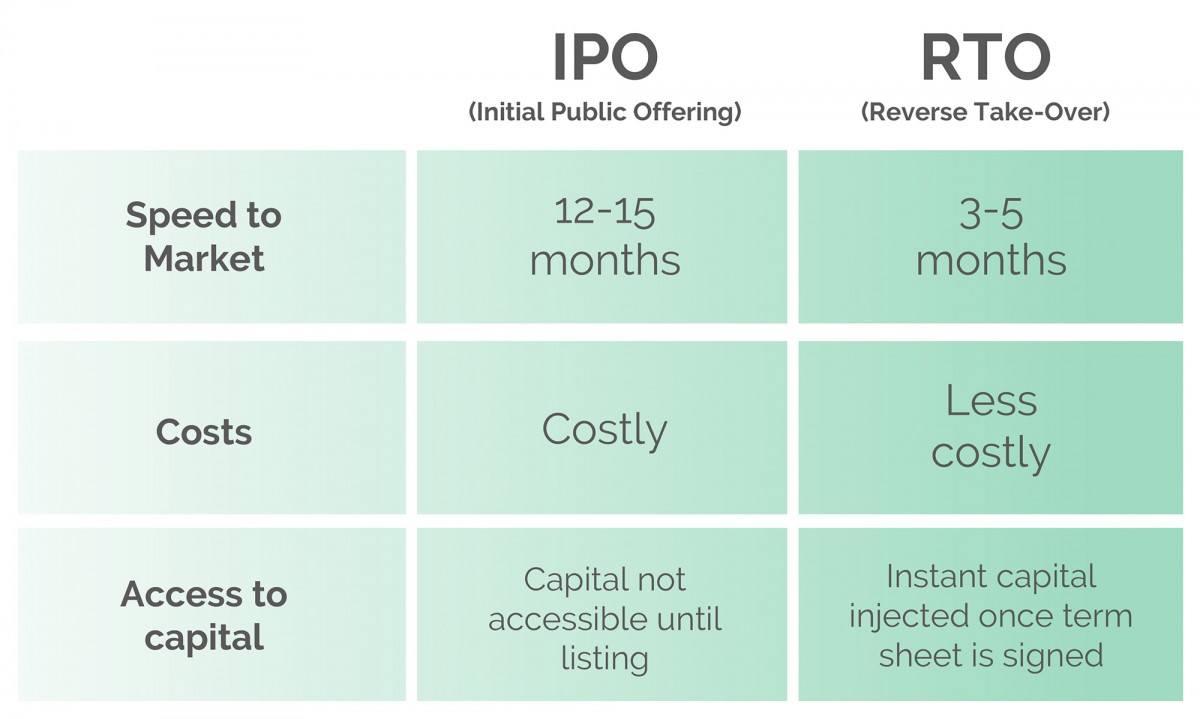

Usually, a company undergoes an RTO route because it is cheaper and quicker than IPO. A company operating in an industry that is not favored by the Securities Commission (SC) or doesn't have a sufficient financial track record will also take this route. If the target company is a good company, it could usually means a new life for the minority shareholders of the original Listco.