Uranium Overview

The European Commission has proposed plans to label nuclear power as green on 2 Jan 2022. This may be the start of a reversal in Uranium demand.

Uranium prices have jumped this week as violent protests in Kazakhstan stoke concerns about the security of supply for the radioactive material. Initially, we thought it's just a supply shock But when we dig deeper, we realize the prices of Uranium may have more legs to run.

Uranium, the chemical symbol U, is a radioactive chemical element that is essential in producing nuclear fuel. It is silvery-white in color when in its natural form. The demand for nuclear power as well as the global supply of uranium often affects the price of the commodity. Its price is often inversely affected by changes in the demand for fossil fuels.

The prices of Uranium have fallen since 2011, the year where Japan experienced its Tsunami and nuclear power plant disaster. Since then, more and more nuclear power plants are being turned off and the demand for Uranium has decreased.

However, things had changed recently. Due to the rising fossil fuel price and overreliance on Russia’s natural gas, the European Commission has proposed plans to label nuclear power as green on 2 Jan 2022. This may be the start of a reversal in Uranium demand.

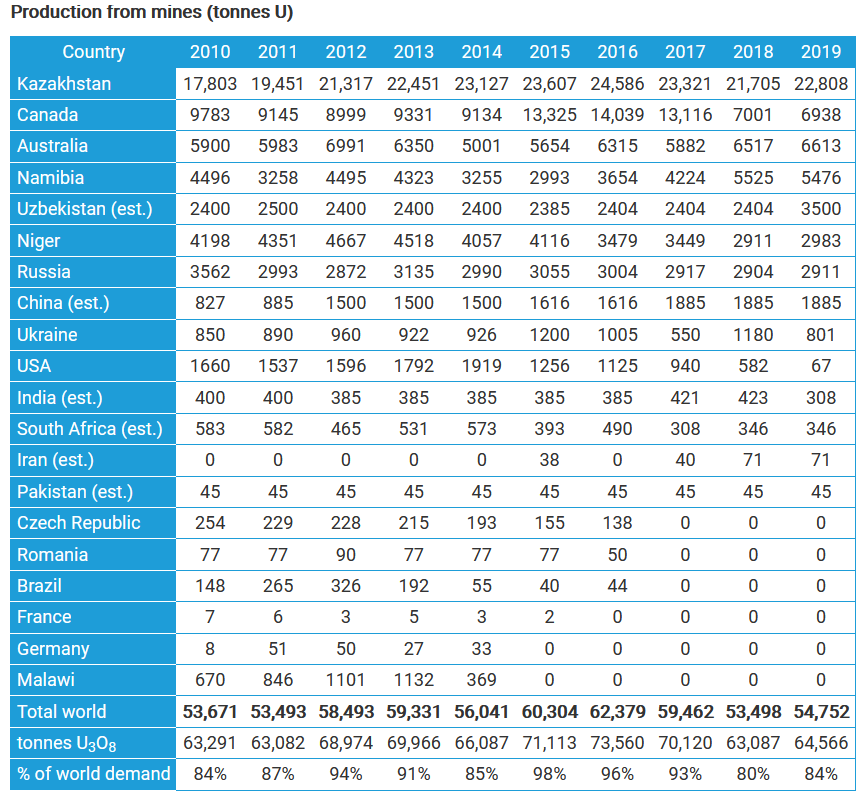

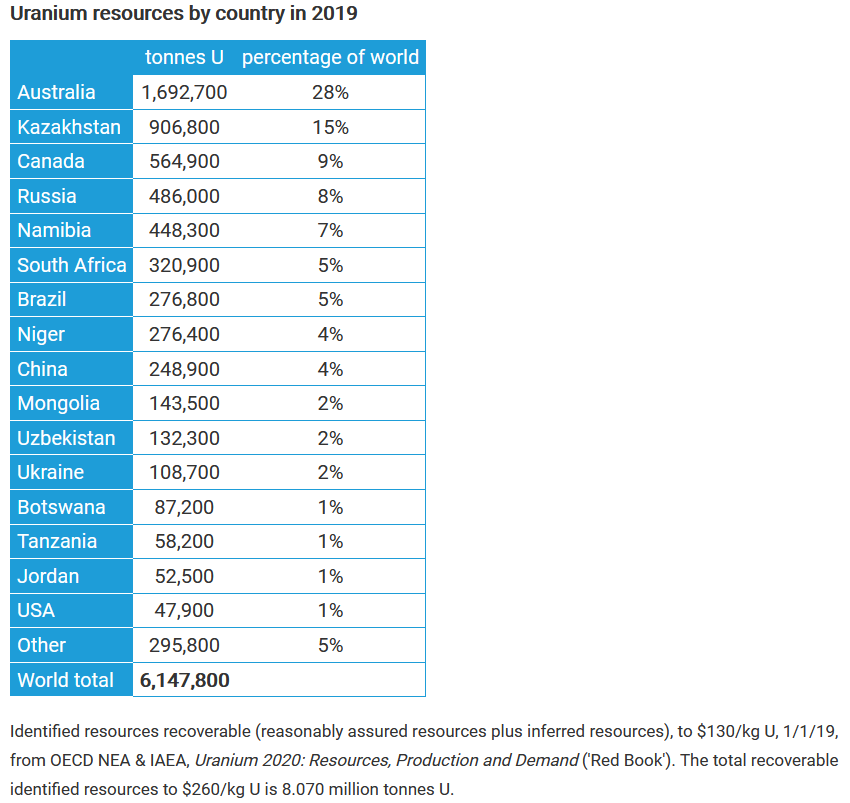

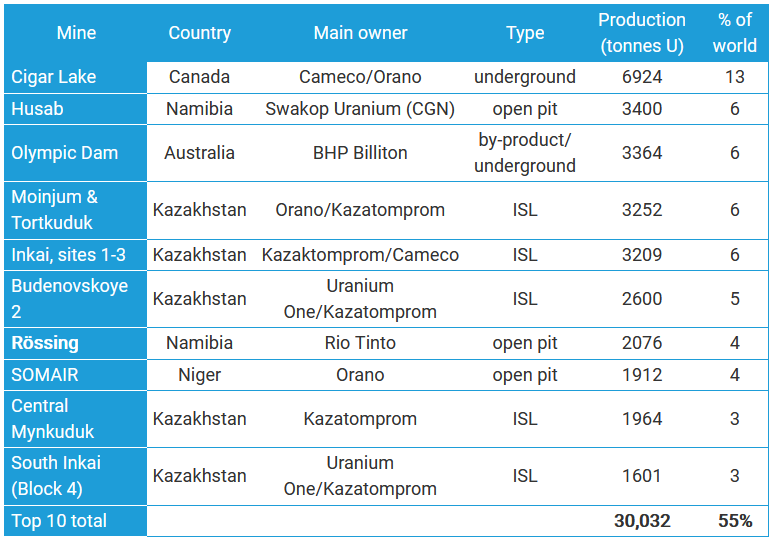

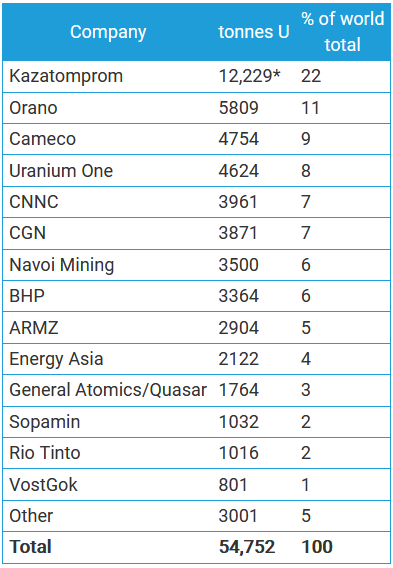

Here’s an overview of this industry

Related Guides

Capital Structure of O&G Industry segments

2023-01-06

|

Energy

|

Tags: Capital Structure

Segments with lower debt are relatively safer investments