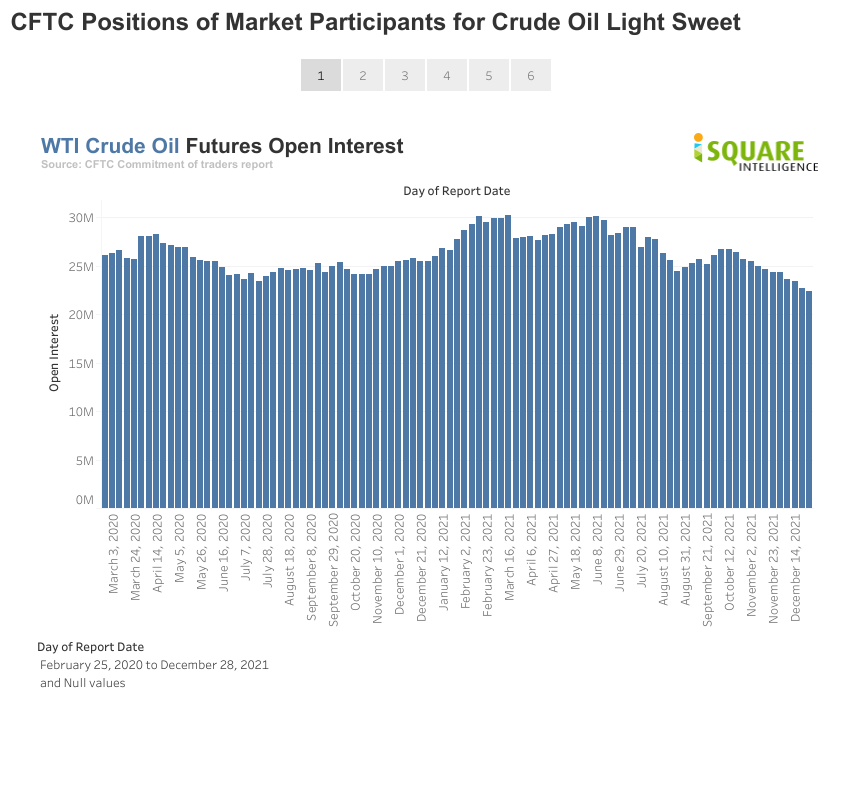

Divergence between oil price and open interest

7 Jan, 2022

Category: Energy

Tags: Crude Oil,Open Interest,Divergence

The price and volume of crude oil is not showing the same signal recently

The oil prices had slowly climbed back to USD 80 per barrel recently. However, when we take a look at the open interest of crude oil futures, we found out that the open interest is declining steadily.

A declining open interest means funds are flowing out from this market instead of flowing in.

Divergence had occurred between the price and volume. Trade at your own risk.

Related Articles

Tokyo Electric Power's Resuming Nuclear Plant

2023-12-28

|

Energy

|

Tags: LNG

Japan resumes its nuclear plant, lesser demand for LNG

Oil price outlook

2023-08-09

|

Energy

|

Tags: Crude Oil

|

Archived

The oil market is not just about the supply and demand of oil.

Updates on crack spread

2023-08-09

|

Energy

|

Tags: Crack Spread

Refineries are not going to deliver an outstanding Q4 2022 result too