Tokyo Electric Power's Resuming Nuclear Plant

28 Dec, 2023

Category: Energy

Tags: LNG

Japan resumes its nuclear plant, lesser demand for LNG

Tokyo Electric Power (TEPCO) has been planning a revival of its nuclear power plants. Recently, Japan's nuclear power regulator lifted an operational ban on its plant. This potential move is sending ripples across the energy market, holding significant consequences for both regional and global dynamics.

Since the Fukushima disaster in 2011, Japan made a strategic decision to shut down its nuclear reactors, turning to liquefied natural gas (LNG) as a primary energy source. This move transformed Japan into one of the largest importers of LNG globally, relying heavily on countries like Qatar, Australia, and Malaysia to meet its energy needs.

If TEPCO rekindles its nuclear ambitions, the demand for LNG is likely to plummet. This shift in Japan's energy strategy could have a profound effect on LNG charter rates and the prices of natural gas globally.

1) Countries heavily invested in supplying LNG to Japan, such as Qatar and Australia, may experience a dip in demand. Simultaneously, it could reshape trade patterns, redirecting LNG shipments to other markets.

2) MISC Berhad, a prominent shipping company and a subsidiary of Malaysia's national oil company, Petronas, might face significant consequences. As one of the major carriers of LNG, a decrease in demand from Japan could directly impact MISC's shipping operations and revenue.

3) Lower energy prices. The reduction in LNG demand from Japan could influence energy prices worldwide. The energy market may become a buyer's market, affecting prices.

Despite the ban being lifted, a resumption still needs

consent from the local government where the nuclear plant is located.

Related Articles

Oil price outlook

2023-08-09

|

Energy

|

Tags: Crude Oil

|

Archived

The oil market is not just about the supply and demand of oil.

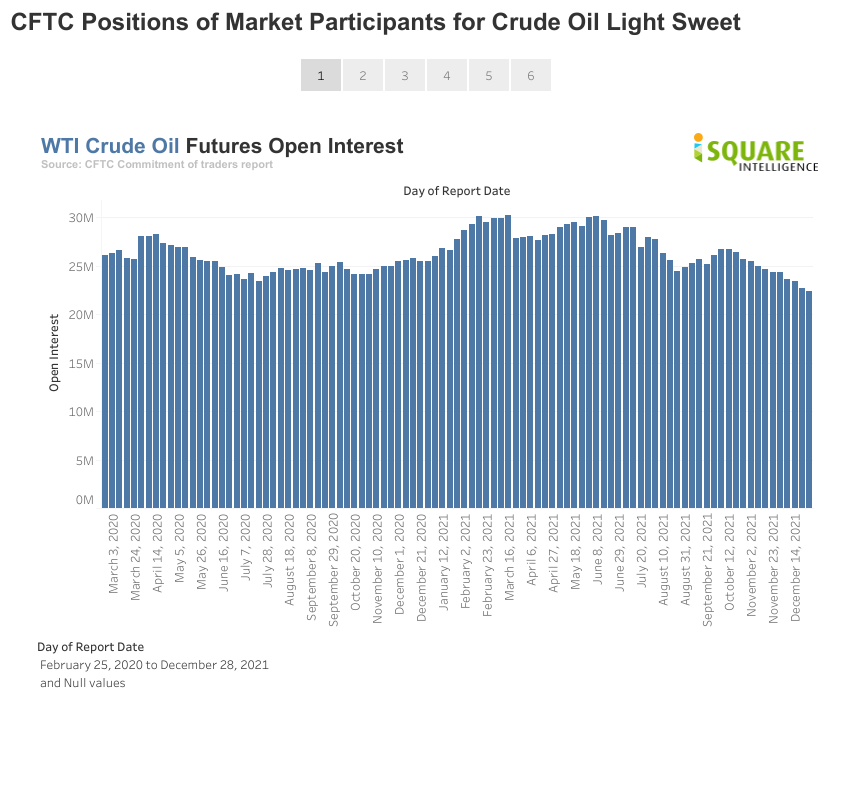

Divergence between oil price and open interest

2023-08-09

|

Energy

|

Tags: Crude Oil, Open Interest, Divergence

The price and volume of crude oil is not showing the same signal recently

Updates on crack spread

2023-08-09

|

Energy

|

Tags: Crack Spread

Refineries are not going to deliver an outstanding Q4 2022 result too