When is the end to the commodity boom?

29 Mar, 2022

Category: Currency

Tags: AUD/JPY

AUD/JPY can be used as a gauge to determine the position of the current commodities cycle.

The Japanese Yen has been very weak recently. The Yen has plunged by 9.6% since the start of the Ukraine Russian war.

Besides the Bank of Japan (BOJ) promise to print money to defend its interest yield, the surge in commodities prices is the most important factor affecting the Japanese Yen.

Japan, a manufacturing powerhouse, imported almost all the raw materials it needs. When commodities prices are going high, the JPY will turn weak, when commodities prices are going low, JPY will strengthen.

In contrast, although Australia is a developed nation, its economy is mainly made up of mineral export, agricultural exports, and energy export.

From the chart we plotted, you can see a high correlation between USD/JPY and the Bloomberg commodities index. As a result, you can use AUD/JPY to gauge whether commodities are still in an upcycle or started their downcycle. When AUD/JPY starts to move downtrend, it usually means the commodities cycle is turning downtrend too. On the other way round, you could also use the Bloomberg commodities index to position your trade for AUD/JPY.

Related Articles

Why JPY Falls after raising Interest Rate

2024-03-28

|

Currency

|

Tags: JPY

JPY reaching 1990 low after raising the interest rate

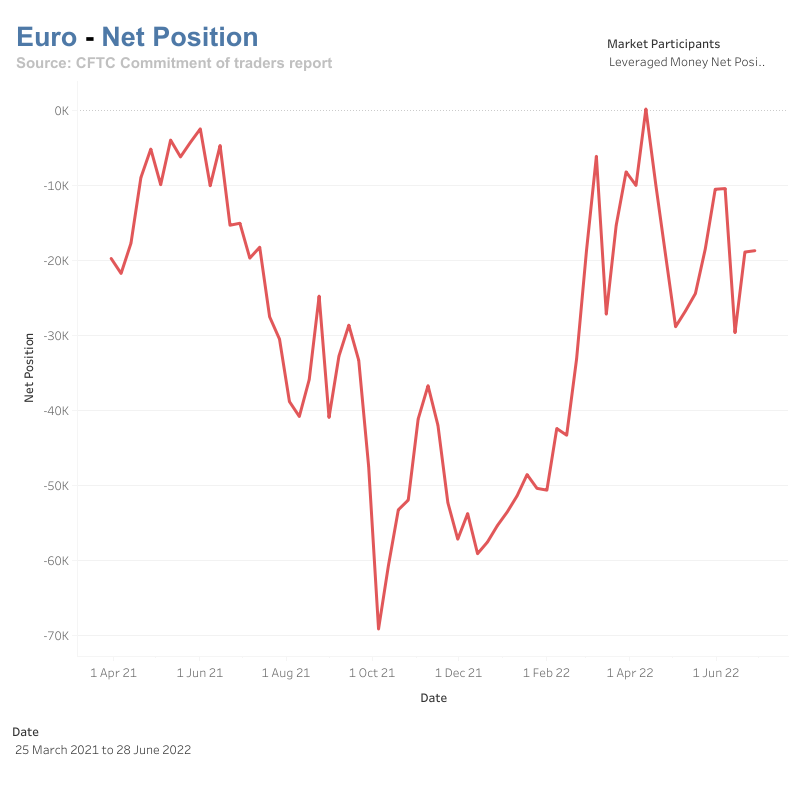

Positions of different market participants for EUR/USD

2023-08-09

|

Currency

|

Tags: EUR, USD

A check on hedge funds' position when EUR/USD is trading at parity.

Major movements in the currency market

2023-08-09

|

Currency

|

Tags: EUR, JPY, KRW

The market is volatile and opportunities arise.