ETF in favors

26 May, 2022

Category: ETF

Tags: Portfolio

Despite the market bloodshed, this fund is still performing great

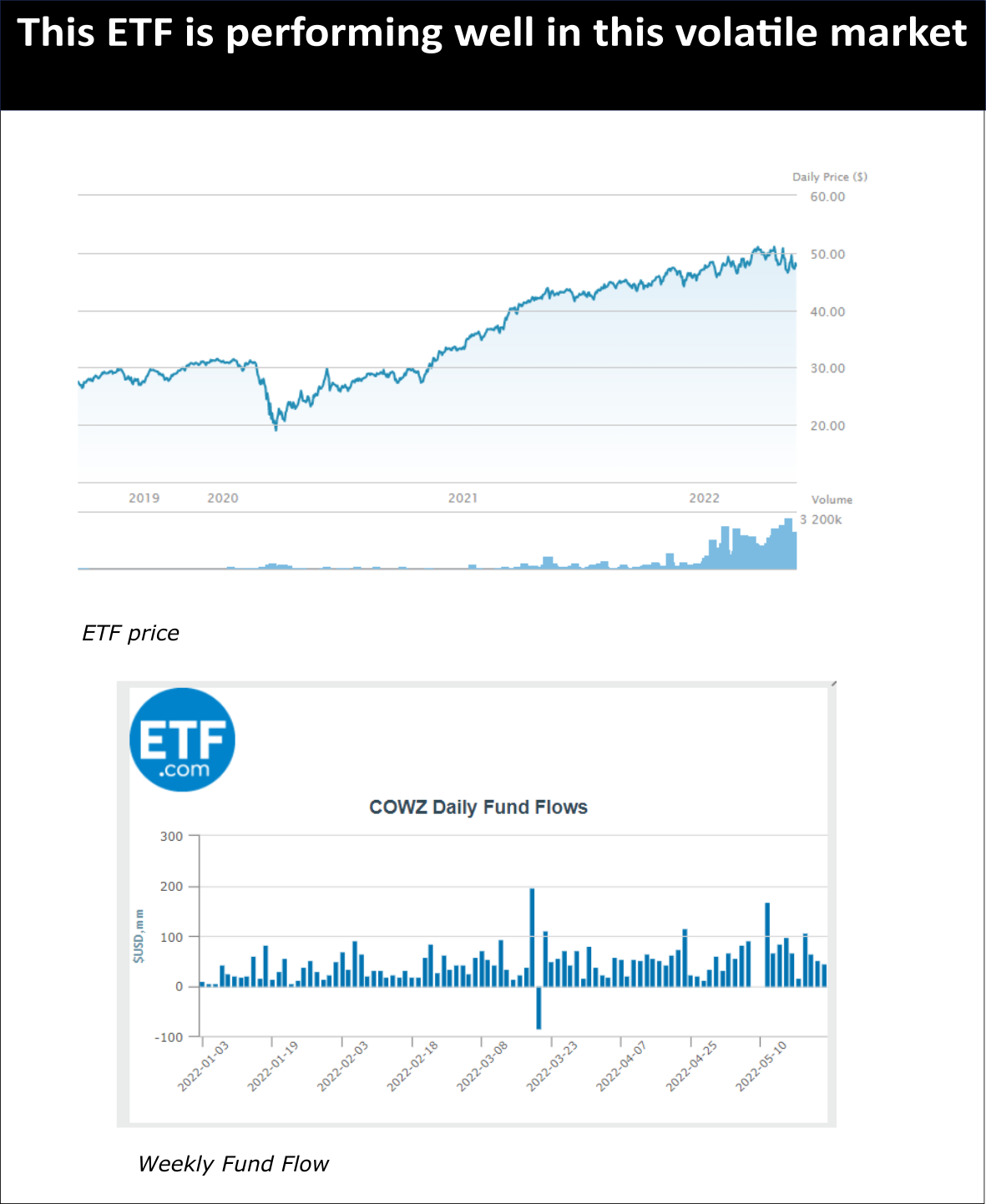

The market is rough these days, but one ETF that is doing relatively well is COWZ.

Pacer US Cash Cows 100 ETF (COWZ), a fund that tracks companies that have lots of free cash flow has seen inflows every single week this year.

You can see that the ETF has maintained its price level when all major stock indexes and asset classes are seeing a price fall of 20%-30%.

One way to think about an ETF is that it's kind of the opposite of something like ARKK. ARKK is all about the future, innovation, and so forth. It's portfolio comprises companies that aren't making a ton of money today and will be the dominant player in the future, and generate a lot of cash in the year 2035 or way further down the road.

Over the last six months, a huge premium is placed on cash and a huge price reduction on promises in the future.

Why did tech stocks do so well between 2010-2021? Well basically, they were the only game in town if you wanted growth. GDP growth was poor throughout all of those years, so the only thing growing, basically, was software and internet companies.

These days growth isn't so scarce anymore. Nominal GDP growth is way hotter than it used to be. Growth isn't confined to one sector. Lots of companies are growing. Oil companies are bringing in cash the way they haven't in ages, brewery companies are expanding their capacity, and plastics manufacturers are increasing their output level

In the past decades, companies were incentivized to go for sales growth. Today it's different. Companies are now incentivized to produce actual cash flow, as opposed to expanding at any cost.

This helps explain why commodities prices have soared so much because there isn't much incentive to expand production aggressively in response to rising prices.

In short, the theme for investing has shifted and cash flow, not growth is something investors want.

Related Articles

VP-DJ Shariah China A-Shares 100 ETF

2023-08-09

|

ETF

|

Tags: ETF

A quick summary and the underlying components of the VP-DJ Shariah ETF.

List of Malaysia ETF

2023-08-09

|

ETF

|

Tags: ETF

A summary of the portfolio of Bursa Malaysia Exchange Trade Fund (ETF). An ETF is similar to a fund/unit trust, except its price is transparent and investors can buy it directly using their stockbroking account.

NASDAQ Golden Dragon China Index

2023-08-09

|

ETF

|

Tags: Portfolio

It's time to look at U.S.-listed Chinese equities.