List of Malaysia ETF

14 Jan, 2022

Category: ETF

Tags: ETF

A summary of the portfolio of Bursa Malaysia Exchange Trade Fund (ETF). An ETF is similar to a fund/unit trust, except its price is transparent and investors can buy it directly using their stockbroking account.

If you do not have a futures account nor a CFD account but you would like to execute long and short positions for different markets, why not gain exposure via investing in ETFs? In fact, Bursa Malaysia had launched quite a number of ETFs that allow investors to gain exposure to different markets. To make it simple for our users, we had compiled a list of ETFs listed on Bursa Malaysia and also their portfolio.

Related Articles

VP-DJ Shariah China A-Shares 100 ETF

2023-08-09

|

ETF

|

Tags: ETF

A quick summary and the underlying components of the VP-DJ Shariah ETF.

NASDAQ Golden Dragon China Index

2023-08-09

|

ETF

|

Tags: Portfolio

It's time to look at U.S.-listed Chinese equities.

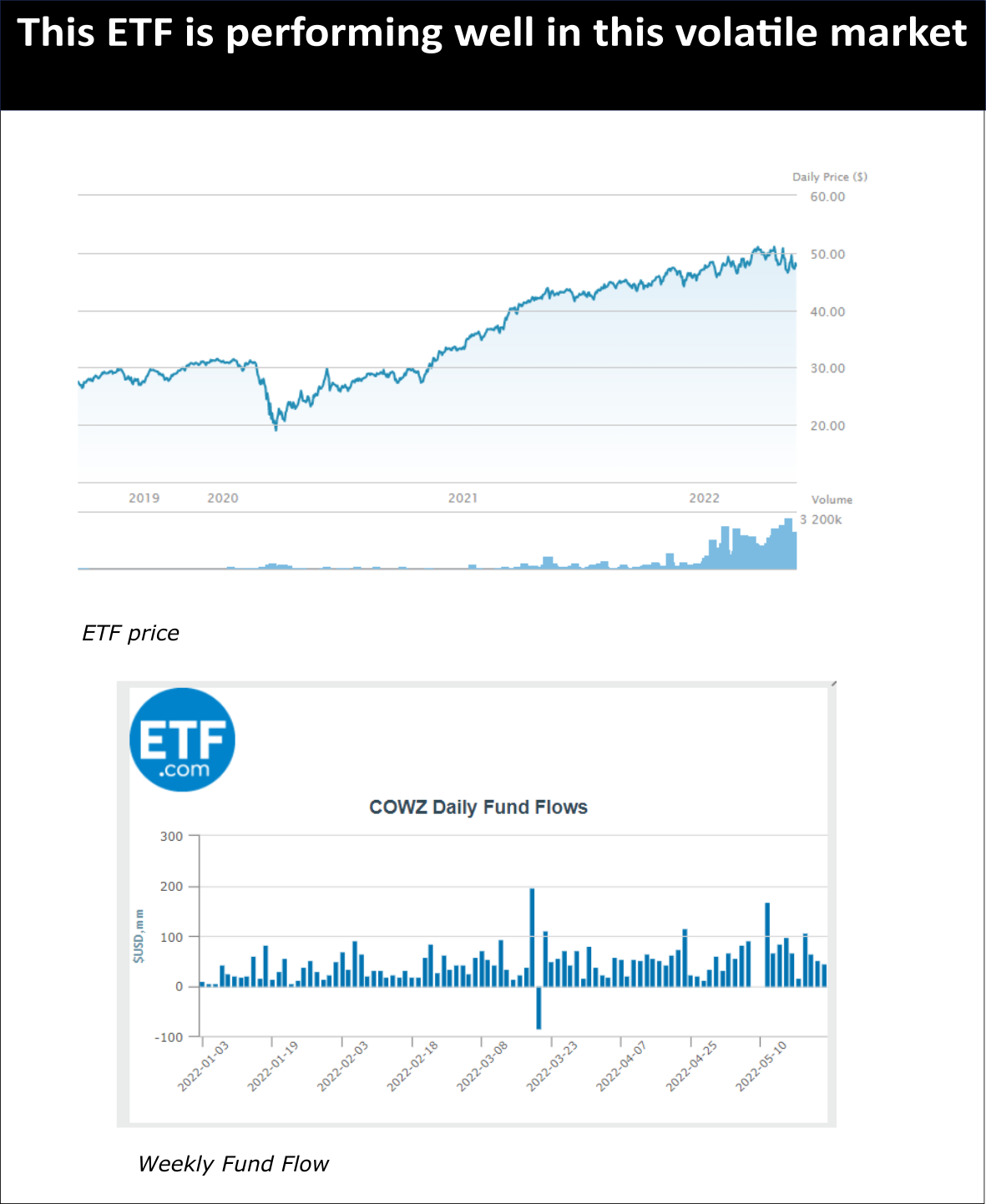

ETF in favors

2023-08-09

|

ETF

|

Tags: Portfolio

Despite the market bloodshed, this fund is still performing great