Some Observation on JPY

21 Apr, 2022

Category: Currency

Tags: JPY

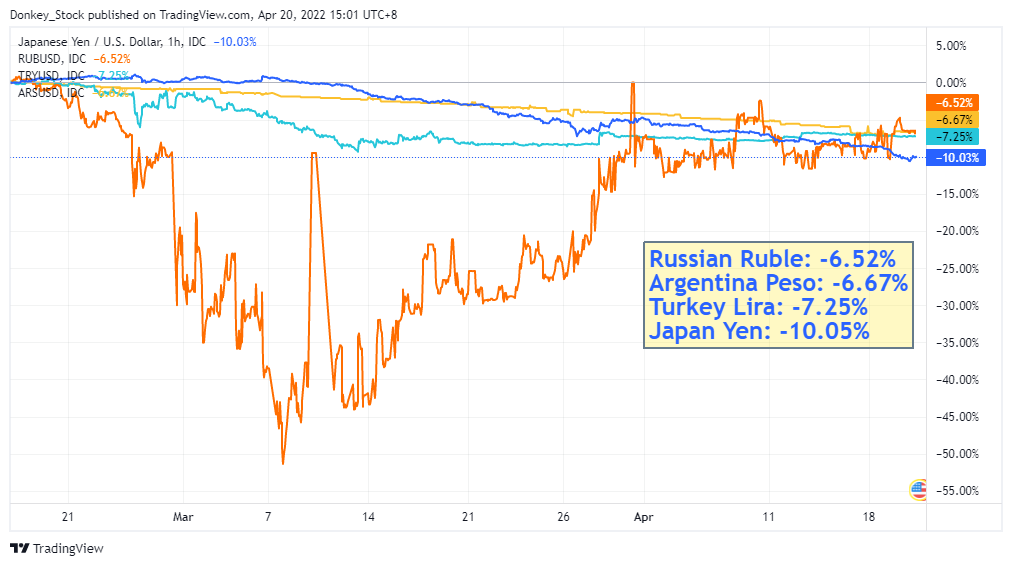

The Japanese Yen is plunging even faster than Turkey's Lira and Argentina's Peso.

Since the Russia Ukraine war started, the

Japanese Yen has dropped 10%, outpacing even the Russian ruble, the Turkish

lira, and the Argentinian peso. The reason why the war is the major culprit

behind the fall of the Japanese Yen had been explained here.

Besides the war, the currency rout is being

fueled by the Bank of Japan's (BOJ) success in capping 10-year Japanese yields

at 0.25%. BOJ has committed to keeping its 10 years bond yield at 0.25% at all

forces, including printing an unlimited amount of money just to support the

bond price.

What are the implications?

A weak Yen is good for Japanese exporters, which

means it could be a threat to companies producing the stuff where Japanese are

good at making, such as automotive, auto parts, chemicals, and machinery.

In order to compete with Japan, most of the Asia

countries that rely on international trade could also devalue their currency in

order to maintain their export competitiveness. When foreign investors are

expecting a downtrend in the Asian countries' currency, their money will leave

this region, the situation is worsening as the US is raising its interest rate.

In short, watch the USD/JPY rate closely. Once

it reaches 135, something bad could happen.

Related Articles

Why JPY Falls after raising Interest Rate

2024-03-28

|

Currency

|

Tags: JPY

JPY reaching 1990 low after raising the interest rate

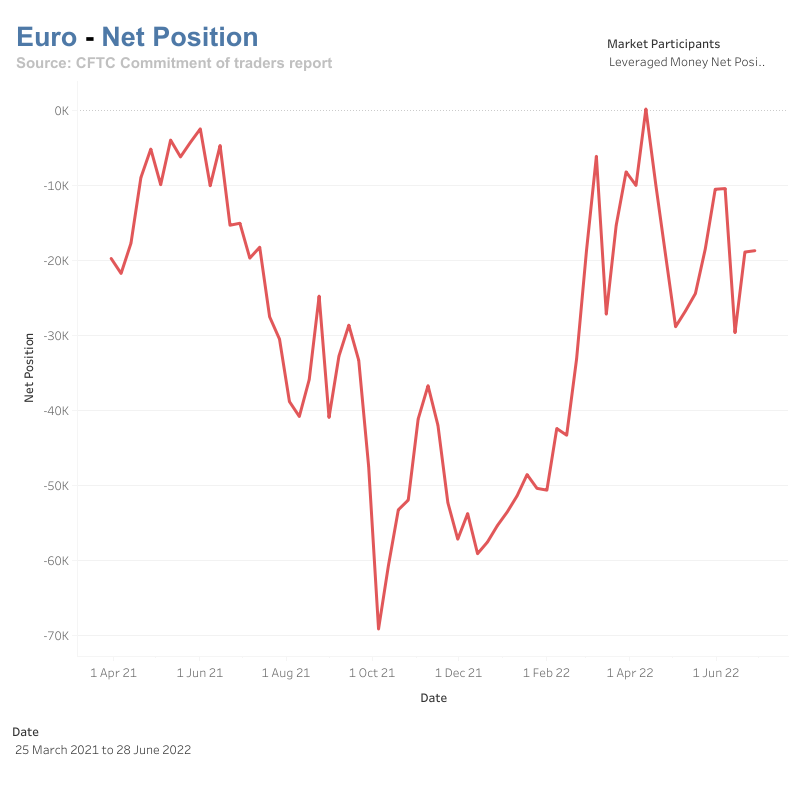

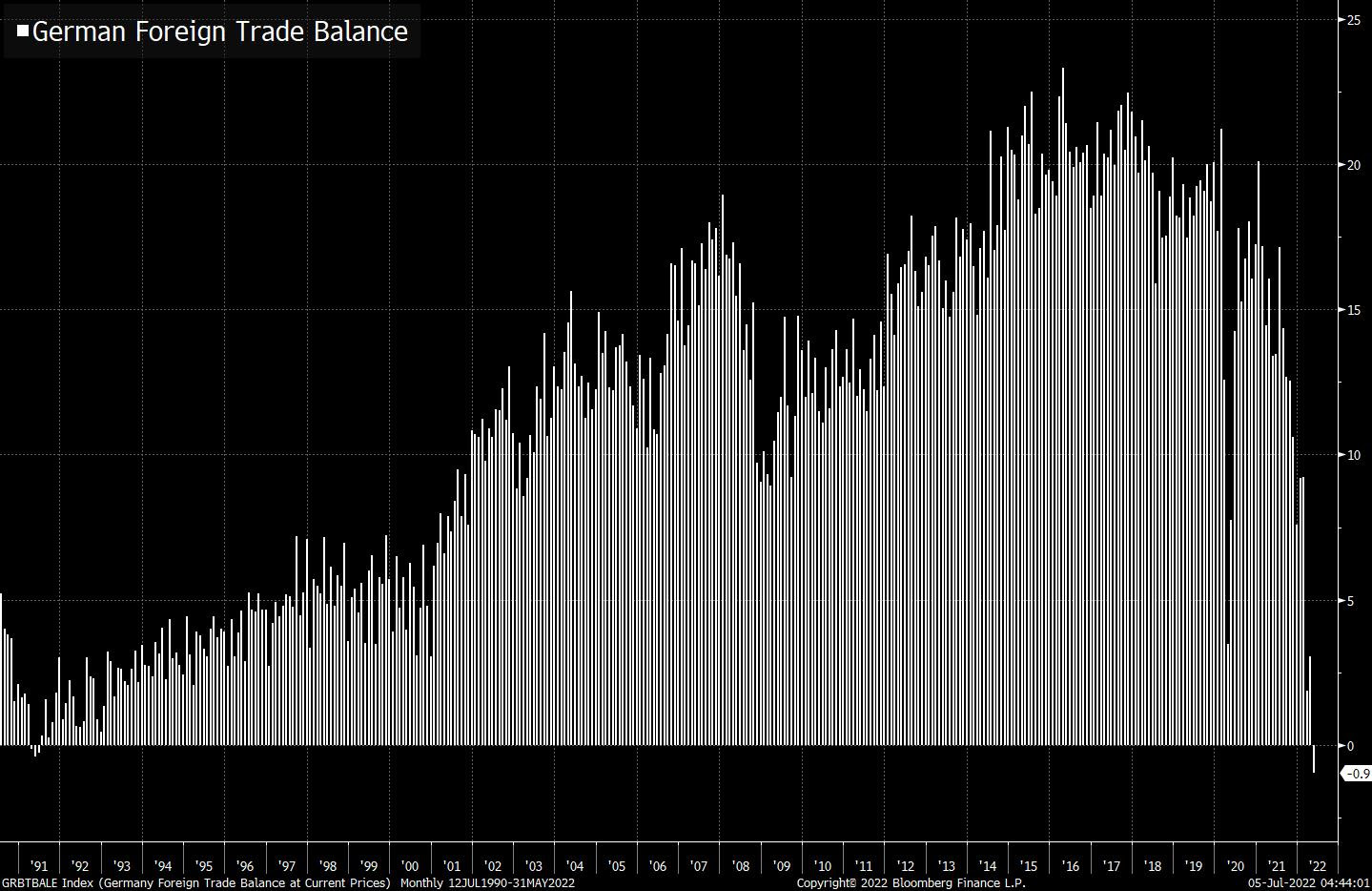

Positions of different market participants for EUR/USD

2023-08-09

|

Currency

|

Tags: EUR, USD

A check on hedge funds' position when EUR/USD is trading at parity.

Major movements in the currency market

2023-08-09

|

Currency

|

Tags: EUR, JPY, KRW

The market is volatile and opportunities arise.