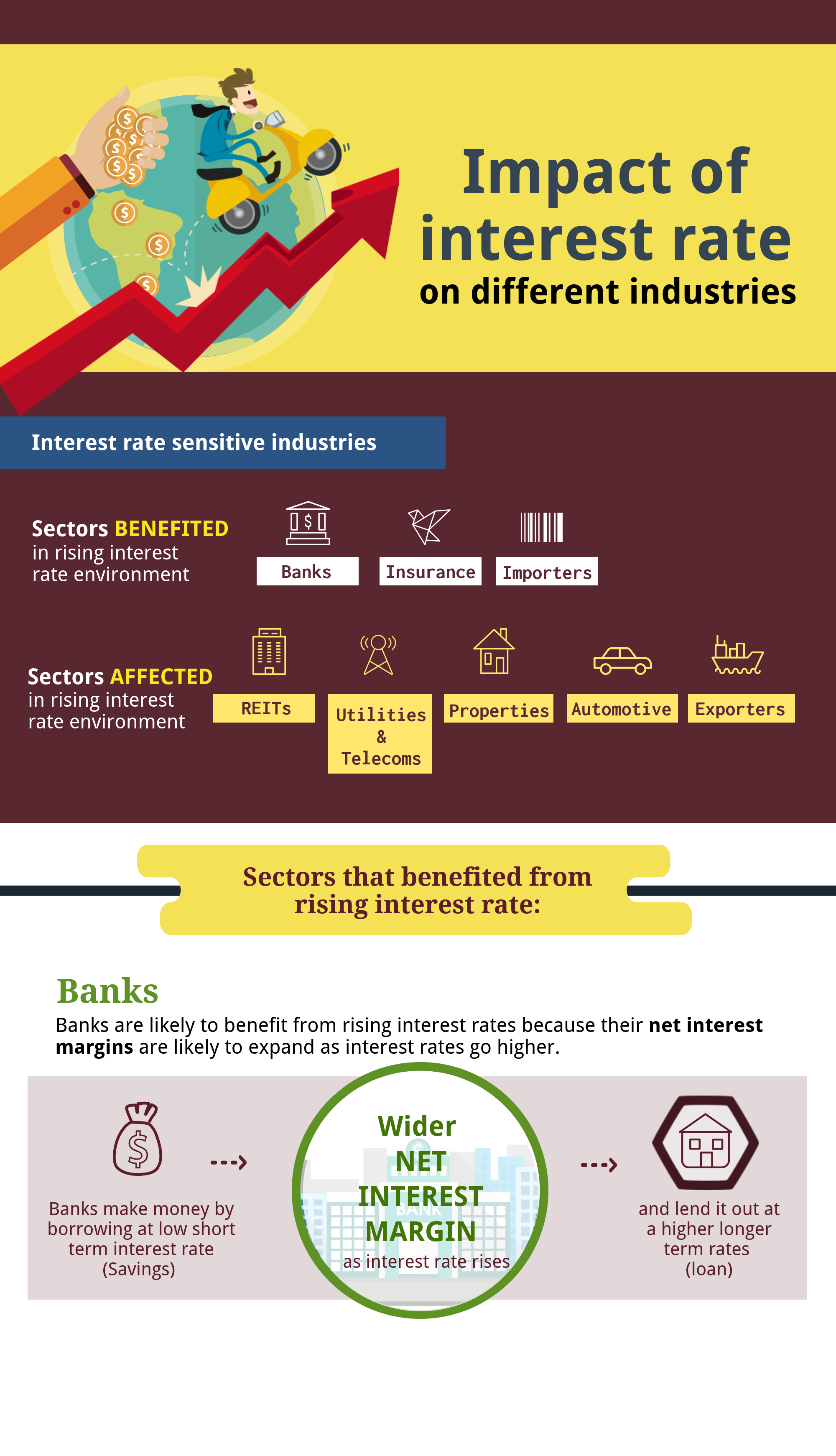

Impact of Interest Rate on different industry

When interest rates are rising, both businesses and consumers will cut back on spending. This will cause earnings to fall and stock prices to drop. On the other hand, when interest rates have fallen significantly, consumers and businesses will increase spending, causing stock prices to rise.

Interest rate is one of the most important factors that move the market. How will the changes in interest rates affect different industries?

Sectors benefited from the rising interest rate environment

Banks

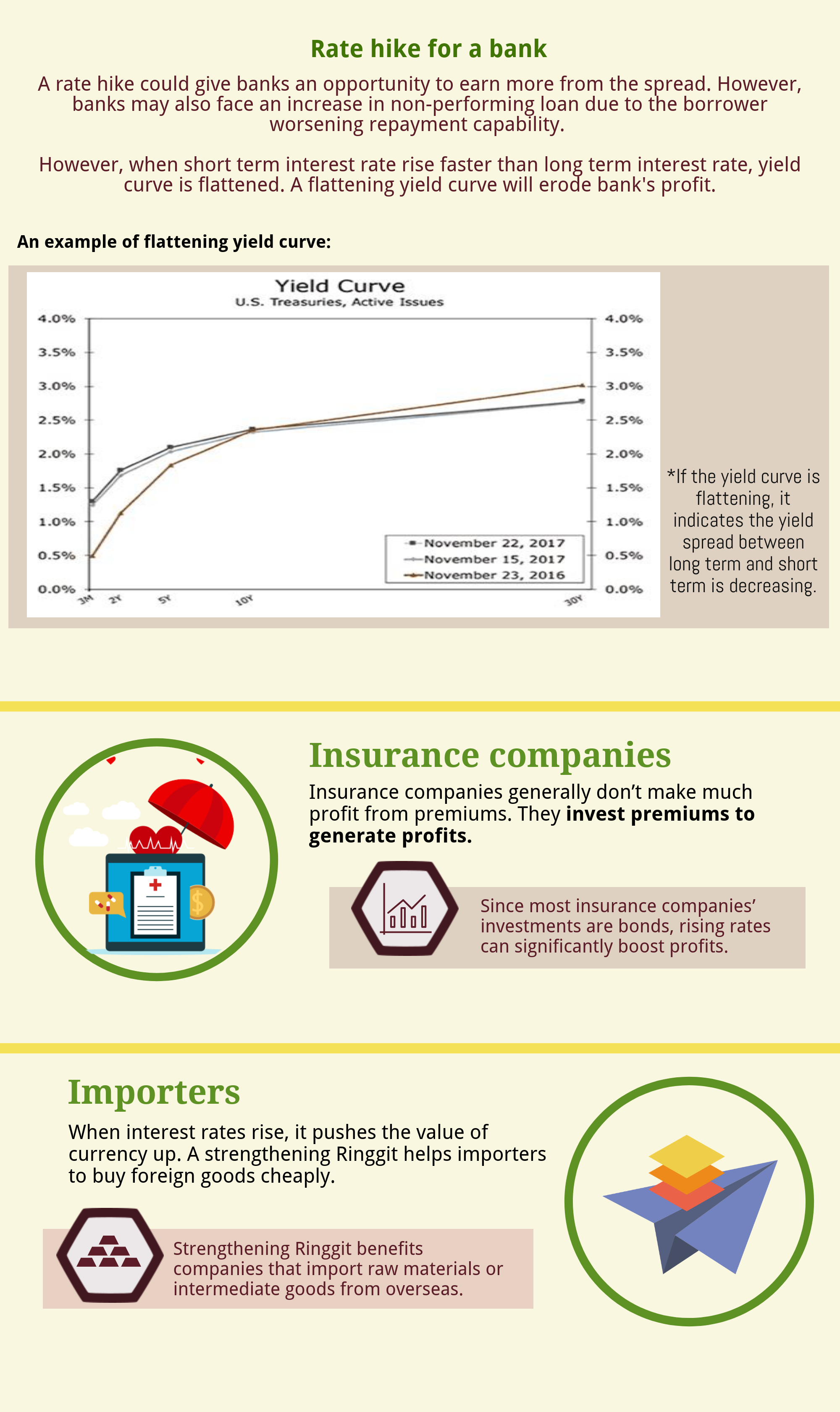

Banks are likely to benefit from rising interest rates because their net interest margins are likely to expand as interest rates go higher. Banks make money by borrowing at a low short-term interest rate (Savings) and lend it out at higher longer-term rates (housing loan). A rate hike could give banks an opportunity to earn more from the spread.

However, banks may also face an increase in non-performing loans due to the borrower worsening repayment capability. Furthermore, when the short-term interest rate rises faster than the long-term interest rate, the yield curve is flattened. A flattening yield curve will erode the bank’s profit.

Insurance companies

Insurance companies generally don’t make much profit from premiums. They invest premiums to generate profits. Since most insurance companies’ investments are bonds, rising rates can significantly boost profits

Importers

When interest rates rise, it pushes the value of currency up. A strengthening currency

helps importers to buy foreign goods cheaply.

Here are some sectors investors should be aware of under the environment of the rising interest rate

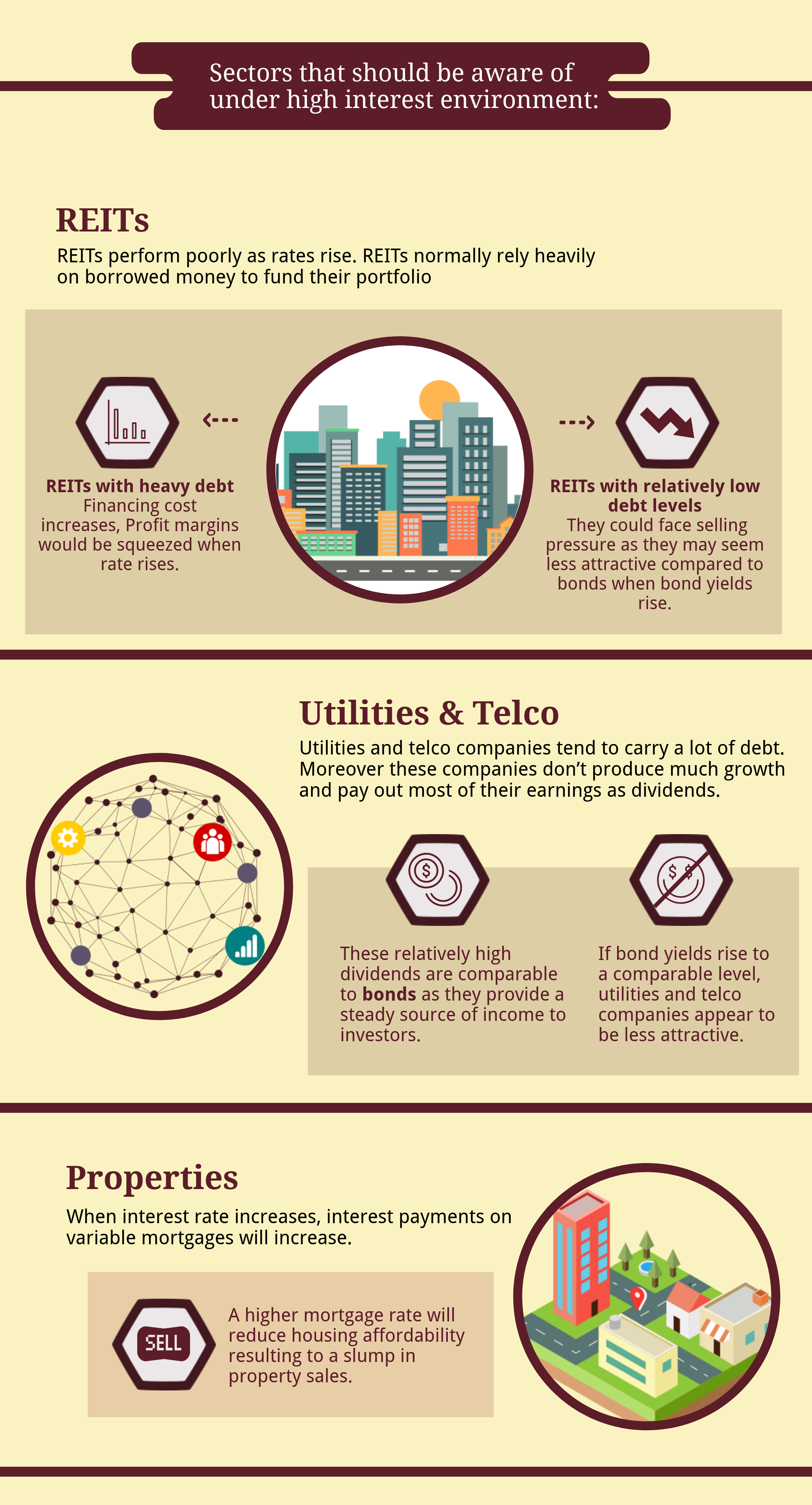

REITs

REITs perform poorly as rates rise. These companies rely heavily on borrowed money and could see profit margins contract if rates increase. As for REITs with relatively low debt levels, they could face selling pressure as they may seem less attractive when bond yields rise.

Utilities and telecoms

Utilities and telco companies tend to carry a lot of debt. Moreover, these companies don’t produce much growth and payout most of their earnings as dividends. In other words, these relatively high dividends are more like bonds as they provide a steady source of income to investors. If bond yields rise to a comparable level, utilities seem to be less attractive.

Property

When the interest rate increases, interest payments on variable mortgages will increase. A higher mortgage rate will reduce housing affordability resulting to a slump in property sales.

Automotive

Due to an increase in interest payments, consumers are suffering a reduction in disposable income. This may hamper consumer sentiment and push back their willingness in purchasing durable goods.

Exporters

When interest rates rise, it pushes the value of currency up. This will make exporters harder to sell Malaysia made products due to a higher price leading to reduced competitiveness.

Interest rate trend is a macro trend where any reversal of the trend is a good time to re-evaluate your portfolio risk and to seek out emerging opportunities

Related Guides

Mental for Value Investing

2022-01-18

|

Guide

|

Tags: Portfolio

Value investing is an investment strategy that involves picking stocks that appear to be trading for less than their intrinsic or book value.

Types of yield curve and its impact to the market

2021-11-26

|

Guide

|

Tags: Portfolio

Yield Curve is a graph that shows how bond yields and maturities are related. Here are the types of the yield curve, factors affecting the yield curve and how the market interpret the different type of yield curve

Types of Coal

2021-11-25

|

Guide

|

Tags: Portfolio

Coal is an abundant natural resource that can be used as a source of energy and is primarily used as fuel to generate electric power. The article illustrates the major types or ranks of coal