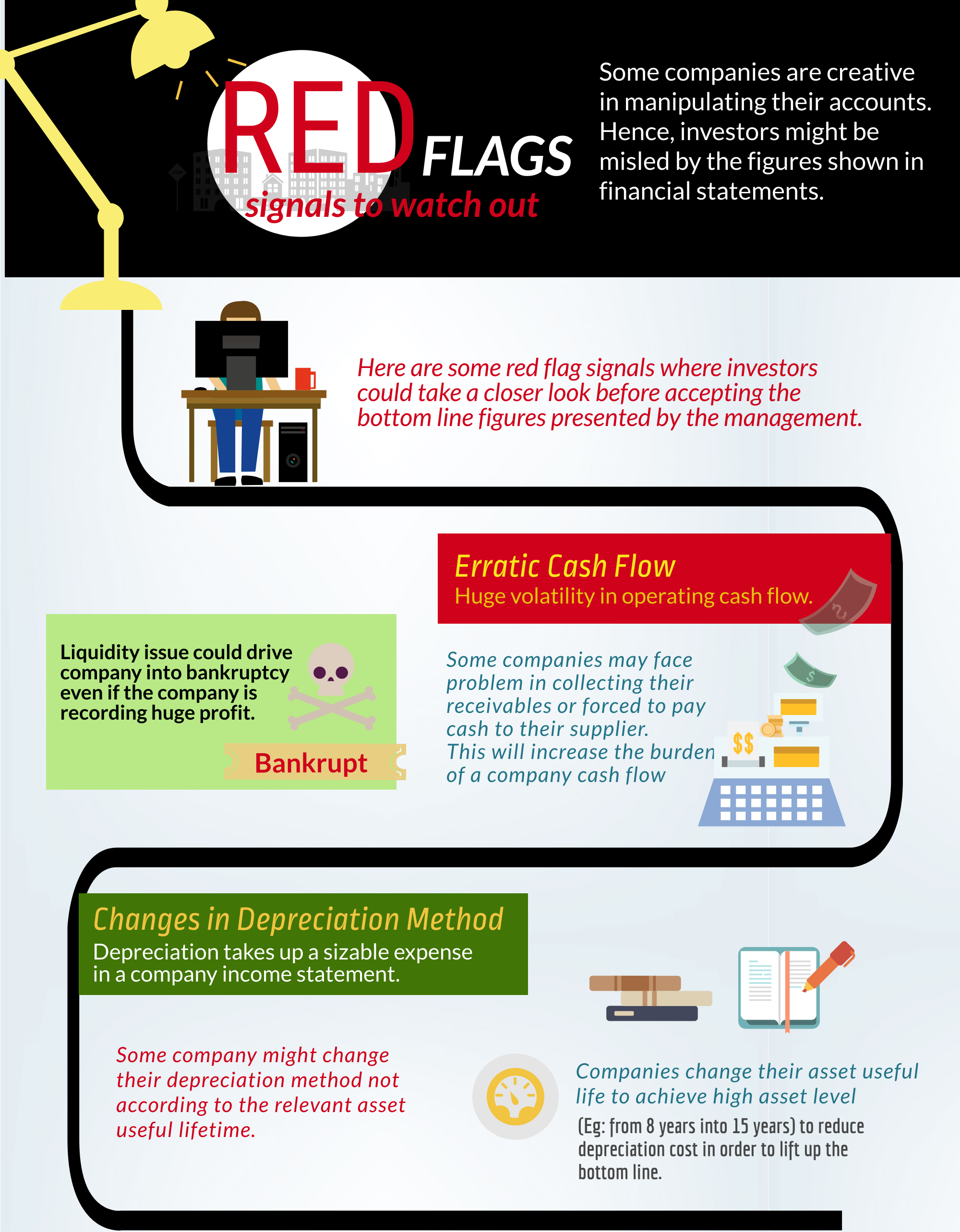

Red Flag Signals to watch out

A red flag is a warning or indicator, suggesting that there is a potential problem or threat with a company's stock, financial statements, or news

Some companies are creative in manipulating their accounts. Hence, investors might be misled by the figures shown in financial statements.

Here are some red flag signals where investors could take a closer look before accepting the bottom line figures presented by the management.

Erratic Cash Flow

Huge volatility in operating cash flow. This signal shows that the company might have problems in managing its cash flow regardless of receiving cash or making payments to suppliers. Some might face pressure from suppliers due to the management's creditworthiness and has a shorter payment term. This will lead the company into a death spiral where liquidity issues could drive a company into bankruptcy even if the company is recording a huge profit.

Changes in Depreciation Method

Depreciation takes up a sizable expense in a company income statement. Some company might change their depreciation method not according to the relevant asset useful lifetime. Companies that require a high asset level to operate may change their asset useful life (Eg: from 8 years to 15 years) to reduce depreciation cost in order to lift up the bottom line.

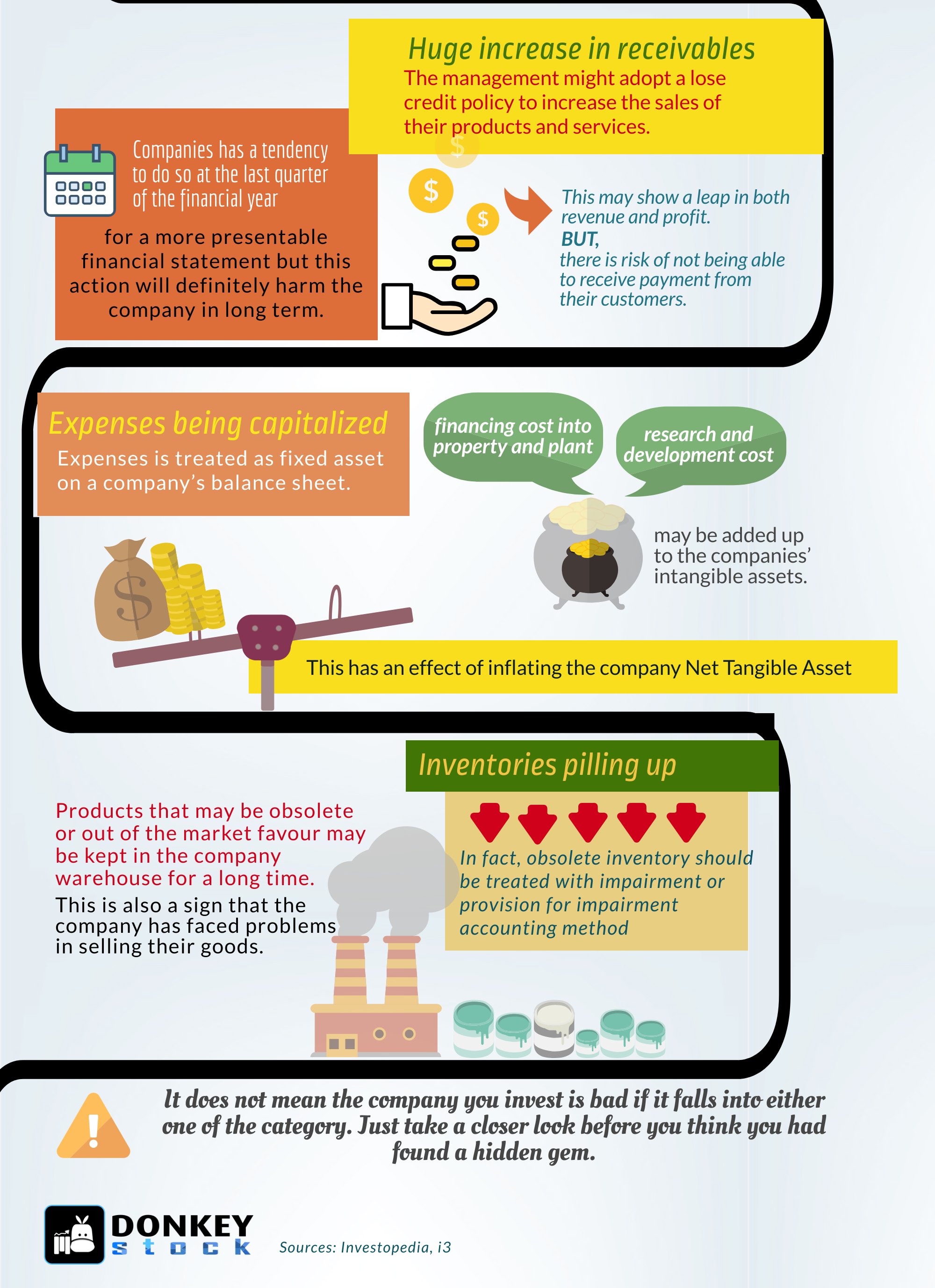

Huge increase in receivables

The management might adopt a loose credit policy to increase the sales of their products and services. This may show a leap in both revenue and profit but ignoring the risk of not being able to receive payment from their customers. Companies have a tendency to do so at the last quarter of the financial year in order to present a more presentable financial statement but this action will definitely harm the company in long term.

Expenses being capitalized

An expense added to the fixed asset on a company’s balance sheet. Companies might convert some of their expenses, such as financing costs into property and plant; research and development costs may be added up to the companies’ intangible assets. This has an effect of inflating the company Net Tangible Asset

Inventories pilling up

Products that may be obsolete or out of the market favor may be kept in the company warehouse for a long time. The management should have made an impairment on the product or provide a provision for impairment regarding the obsolete inventory. This is also a sign that the company has faced problems in selling its goods.

It does not mean the company you invest in is bad if it falls into either one of the categories. Just take a closer look before you think you had found a hidden gem.

Related Guides

Mental for Value Investing

2022-01-18

|

Guide

|

Tags: Portfolio

Value investing is an investment strategy that involves picking stocks that appear to be trading for less than their intrinsic or book value.

Types of yield curve and its impact to the market

2021-11-26

|

Guide

|

Tags: Portfolio

Yield Curve is a graph that shows how bond yields and maturities are related. Here are the types of the yield curve, factors affecting the yield curve and how the market interpret the different type of yield curve

Types of Coal

2021-11-25

|

Guide

|

Tags: Portfolio

Coal is an abundant natural resource that can be used as a source of energy and is primarily used as fuel to generate electric power. The article illustrates the major types or ranks of coal