Understanding Crude Oil

Crude oil is a global commodity that trades in markets around the world, both as spot oil and via derivatives contracts. Crude oil is the single most important commodity in the world as it is currently the primary source of energy production.

Benchmark Oil and Oil Characteristic

West Texas Intermediate (WTI) and Brent are the 2 major oil traded globally. Besides this 2 benchmark, the other major benchmark crude oil in the world is Dubai Oil and Shanghai Oil. Shanghai Oil is a Futures that aimed to provide a much more accurate pricing for Asia oil market.

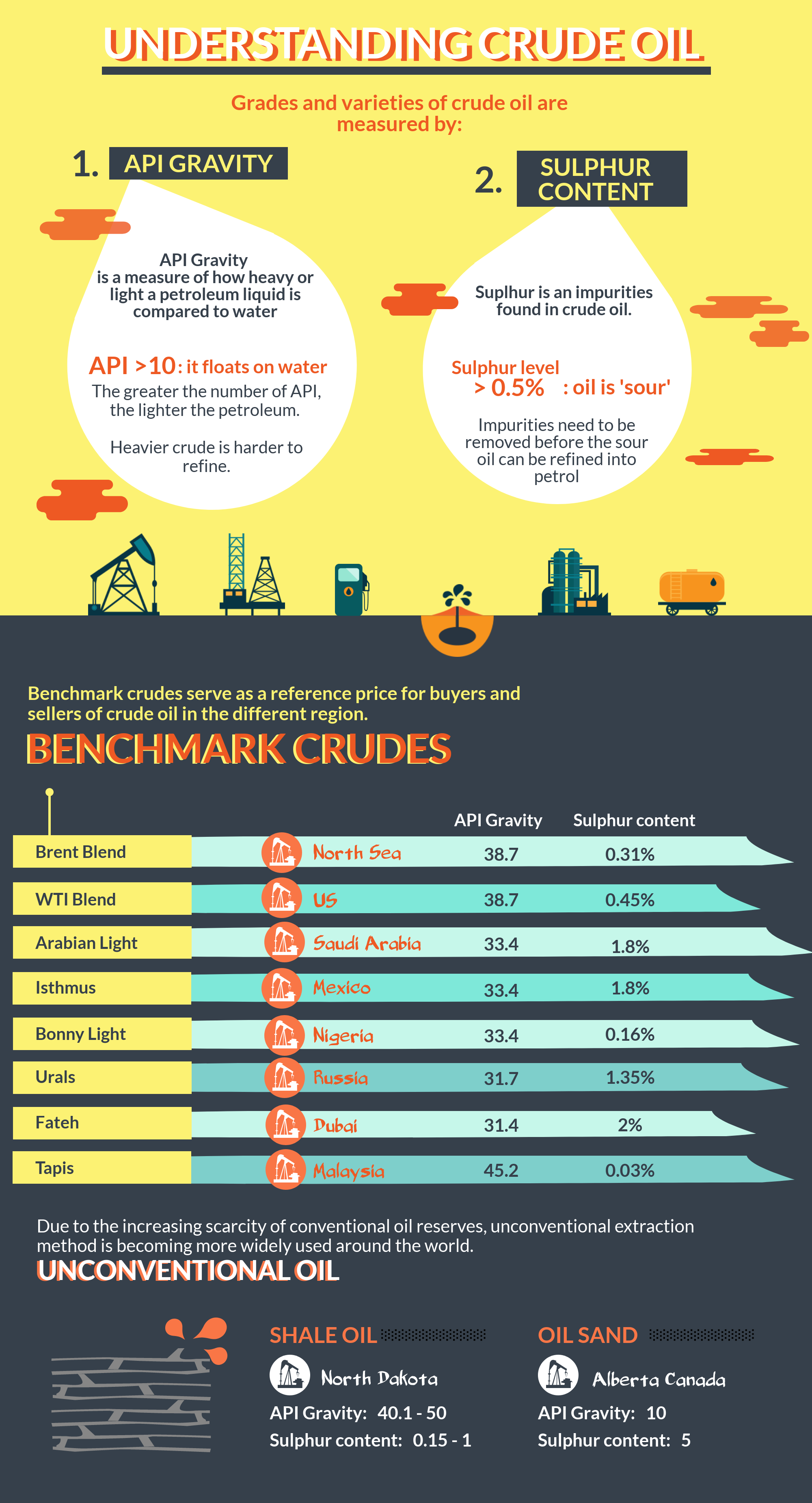

The grade and varieties of crude oil are measured by API Gravity and Sulphur Content.

API Gravity is a measure of how heavy the oil is compared to water. The Greater the number of API, the lighter the oil is. Heavier crude is harder to be refined into petroleum

Sulphur Content is the impurities found in the crude oil. If the sulphur level is higher than 0.5%, the oil is considered sour. Impurities need to be removed before the sour oil can be refined into petroleum.

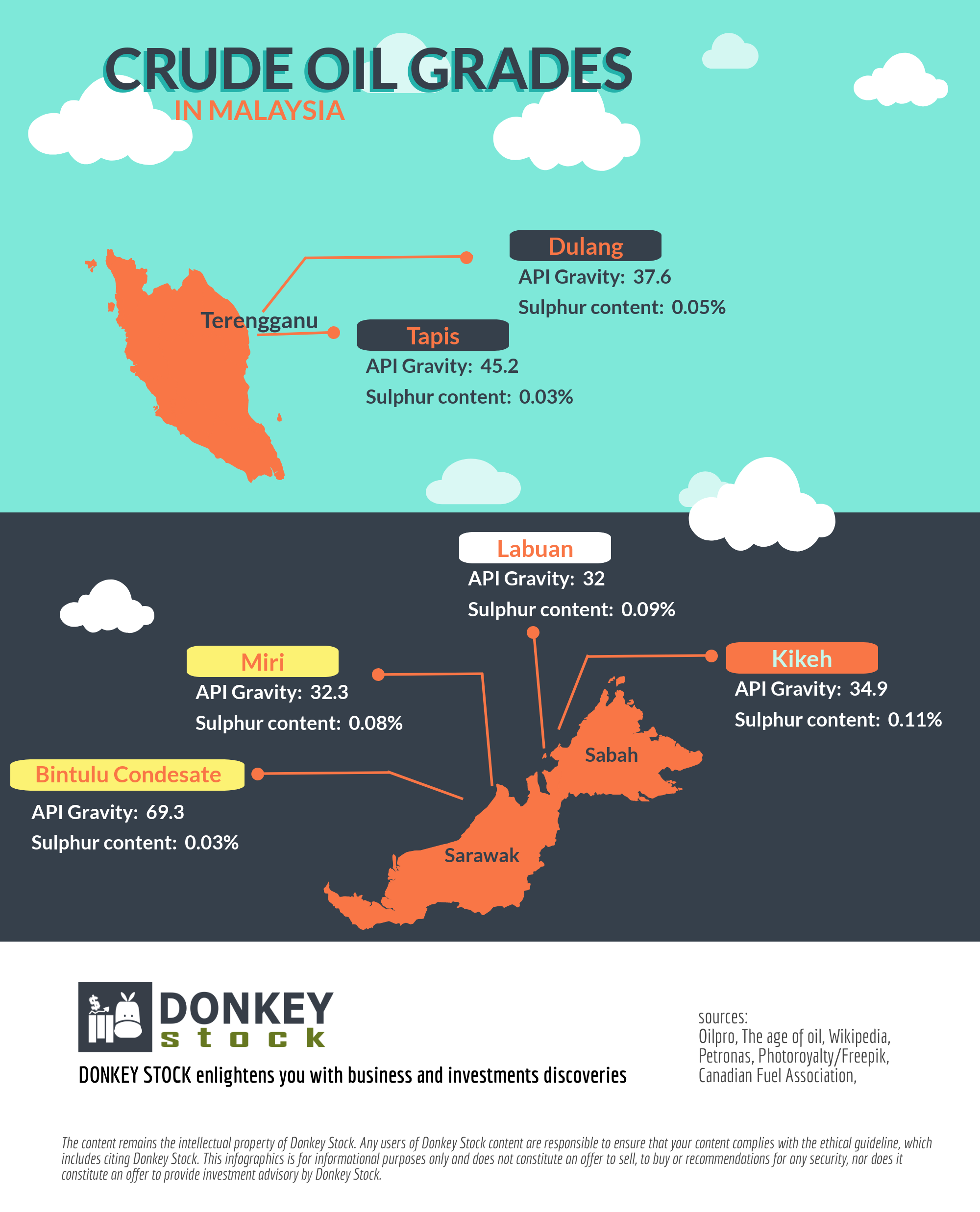

Oil are not traded at the same price due to the different characteristics of oil. Malaysia Tapis, which has lower sulphur content is usually traded at a premium of around USD 4 per barrel to Brent while Alberta Oil Sand is traded at a discount of USD 30 per barrel to WTI.

However, investors should understand that although WTI has been trading at a discount against Brent, WTI is a higher quality oil. The reason for the trading discount is due to the oversupply of oil in US and the higher demand for oil in Asia. (Oil field that produces Brent Oil is nearer to Asia)

Oil Investment Cycle

Historically speaking, the oil & gas sector goes through long, 30-year investment cycles driven by the market’s risk appetite for long-term investments.

Cost tends to rise in the Expansion Phase of the oil investment cycle, led by perceived future supply shortages, easy credit, market fragmentation and rising inefficiencies. Cost inflation compounded at 10% per year in the 2003-13 period, destroying the producers’ returns and only partially benefitting oil services. During this period, oilfield service providers benefited the most.

In contrast, during the Contraction phase, returns improve slowly but consistently, led by an oligopolistic market structure, better management of the supply chain, and advantaged resource access.

EV is making the oil supply market tighter

The focus on the electric vehicle is dis-incentivizing investments in long-cycle capacity. While shale provides enough short-cycle production to prevent the market from running into shortages, the lack of long-term investment keeps the physical markets tight. Concerns about EV demand displacement is taking more future supply off the market through lack of financing. Decarbonization is actually having a net tightening effect on the oil market.

Related Guides

Mental for Value Investing

2022-01-18

|

Guide

|

Tags: Portfolio

Value investing is an investment strategy that involves picking stocks that appear to be trading for less than their intrinsic or book value.

Types of yield curve and its impact to the market

2021-11-26

|

Guide

|

Tags: Portfolio

Yield Curve is a graph that shows how bond yields and maturities are related. Here are the types of the yield curve, factors affecting the yield curve and how the market interpret the different type of yield curve

Types of Coal

2021-11-25

|

Guide

|

Tags: Portfolio

Coal is an abundant natural resource that can be used as a source of energy and is primarily used as fuel to generate electric power. The article illustrates the major types or ranks of coal